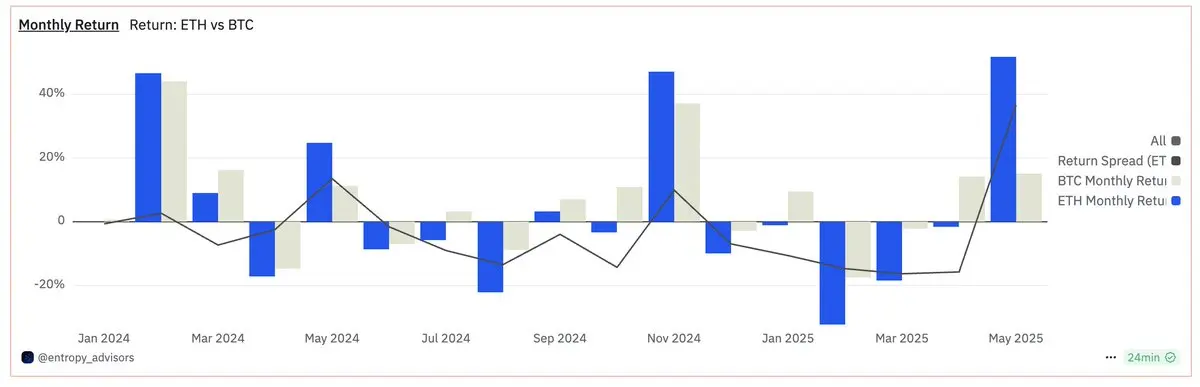

ETH sedang mengalami bulan dengan kinerja terbaik sejak 2024, dengan imbal hasil bulanan sebesar 50%.

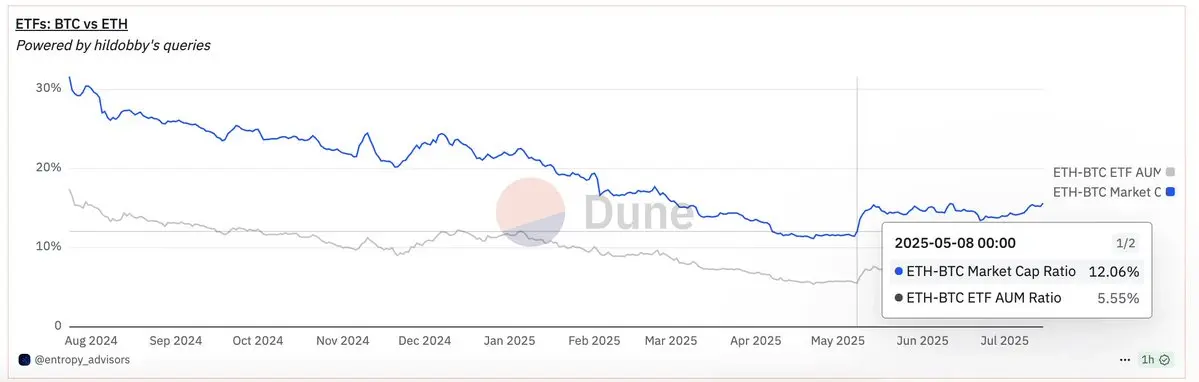

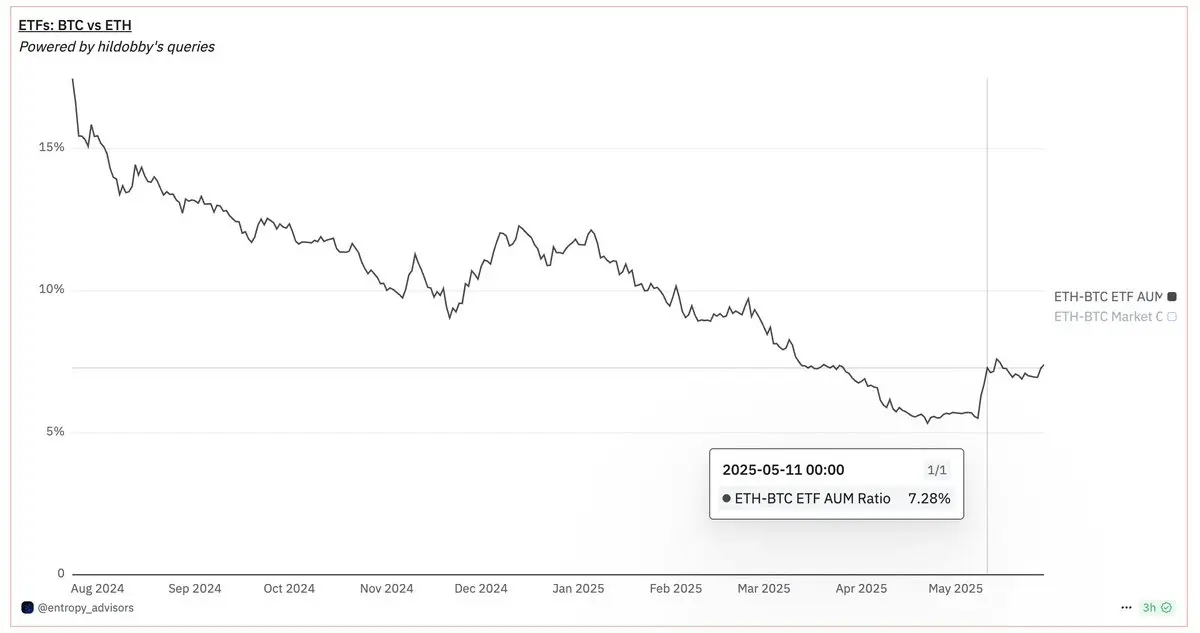

Pada bulan Mei 2025, BTC memiliki imbal hasil sebesar 15%, sementara ETH memiliki imbal hasil sebesar 51%, menghasilkan selisih imbal hasil sebesar 36%. Seperti yang Anda lihat, ini adalah kasus langka setelah peluncuran ETF BTC dan ETH. Sejak 2024, BTC telah mengungguli ETH 13 dari 17 kali.

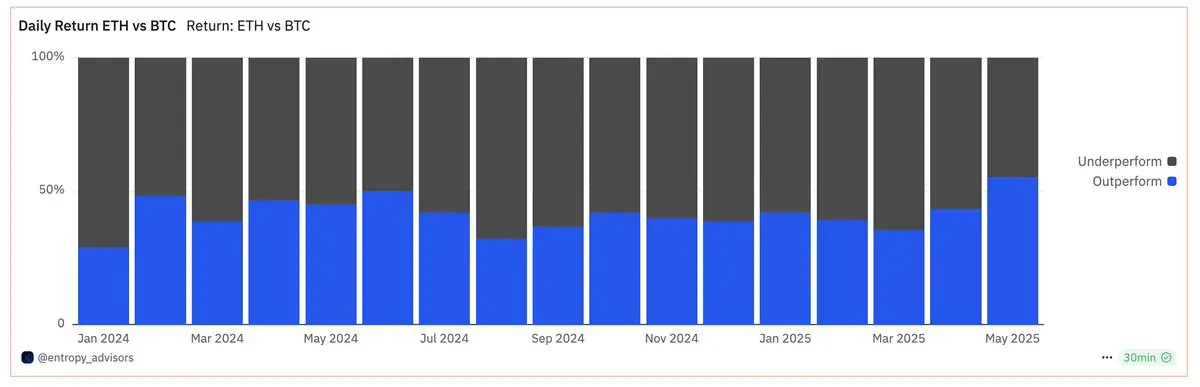

Dalam basis pengembalian harian, ETH telah berkinerja lebih buruk daripada BTC lebih dari 50% pada sebagian besar bulan kecuali Mei, di mana ETH telah berkinerja lebih baik daripada BTC dalam 55% dari hari

Lihat Asli