XRP Price Prediction: 95% Odds for Spot ETF Approval Could Push XRP Toward $4 by Year-End

XRP Spot ETF Approval Momentum Accelerates

As another wave of ETF activity sweeps through the crypto market, XRP is attracting significant attention as a promising asset. It is following in the footsteps of Bitcoin and Ethereum. Bloomberg analysts James Seyffart and Eric Balchunas now estimate the probability of an XRP spot ETF being approved at a staggering 95%, placing it alongside Solana and Litecoin as leading high-potential candidates.

Leading firms such as Grayscale, Bitwise, 21Shares, and Franklin have already filed spot XRP ETF applications with the SEC. The final decision, according to the official timeline, is expected by October 17, 2025.

XRP Price in High-Level Consolidation

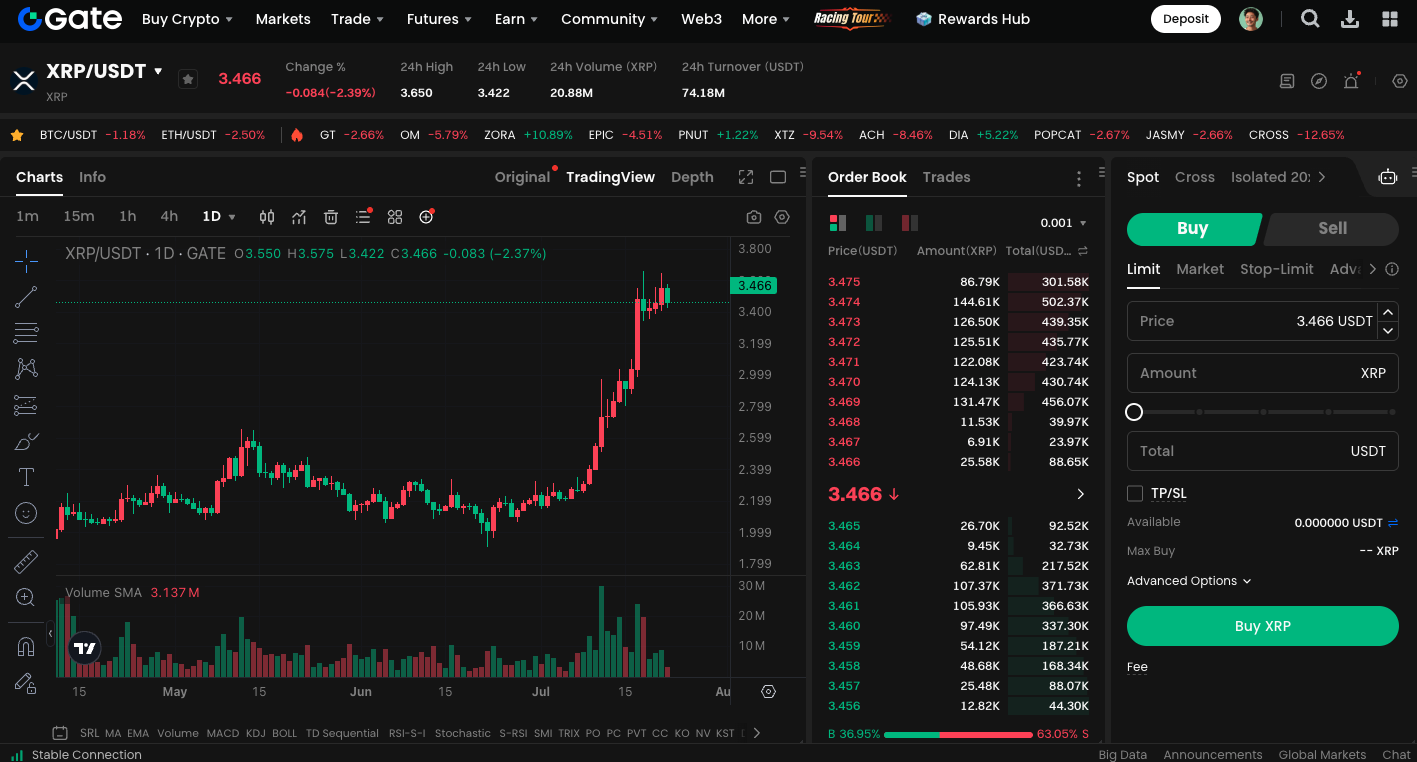

Despite regulatory developments fueling optimism, XRP recently broke above its previous high of around $3.40. It is currently consolidating between $3.40 and $3.65, showing limited price momentum for a decisive move in the near term. Analysts note that a drop below $3.40 could trigger a retest of the $3.00–$3.15 support zone. Investors are focusing on ETF progress as a potential driver for a bullish breakout.

XRP Targets $4 by Year-End

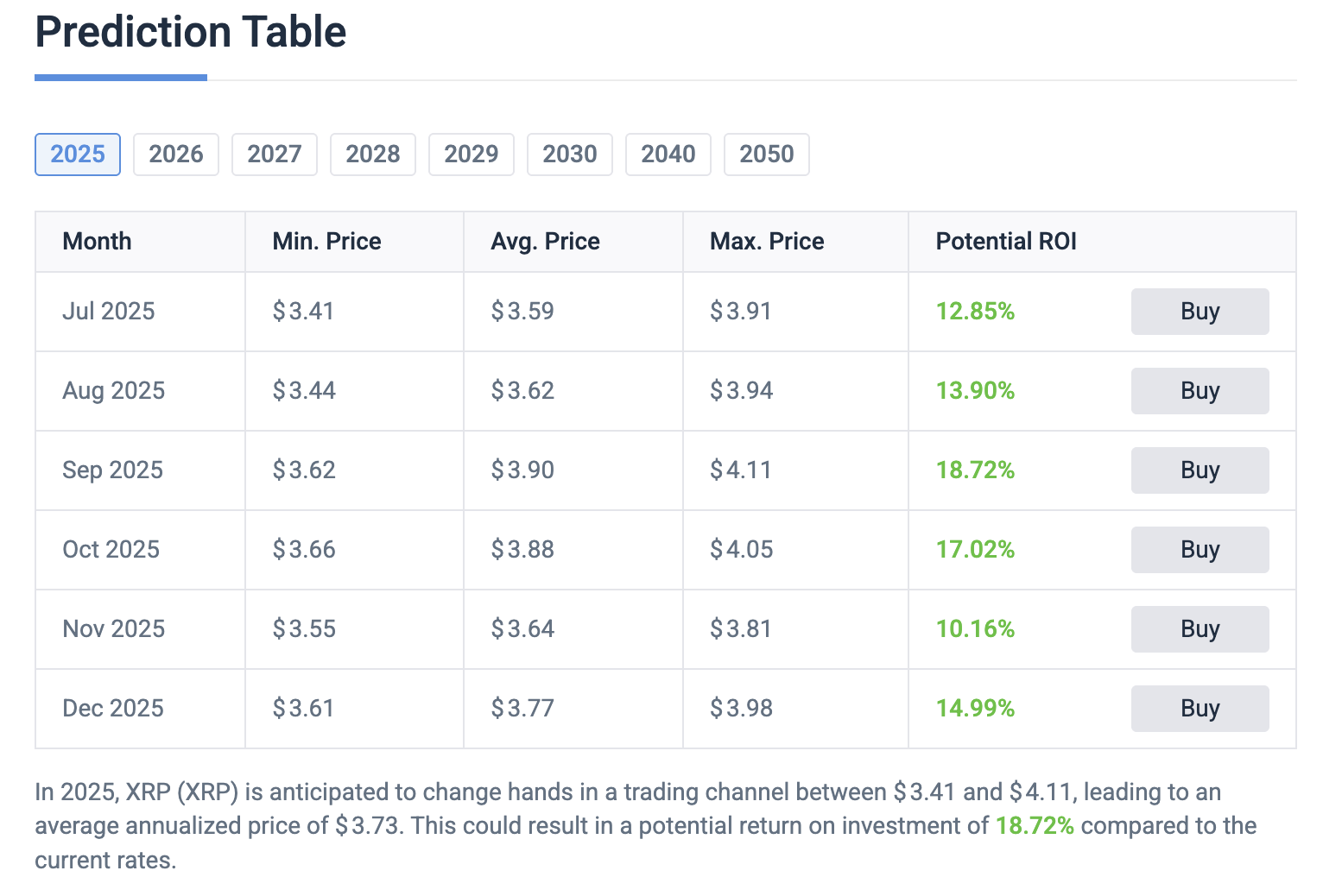

CoinCodex projects that XRP could see a price rally steadily throughout the second half of 2025.

For July, the projected range is $3.41–$3.91, implying about a 13% upside from current levels.

By September, the price could climb to $3.60, with an average estimate near $4.11.

October—a pivotal period for ETF approvals—carries a forecasted range of $3.66–$4.05.

If bullish momentum persists through December, XRP could reach $4.00, representing a significant 45% annual gain.

(Source: CoinCodex)

For spot trading of XRP, visit: https://www.gate.com/trade/XRP_USDT

Conclusion

While XRP remains rangebound in the short term, ongoing regulatory progress, rising institutional participation, and positive forecasts are shifting the medium- and long-term outlook toward a more bullish stance. As the odds of spot ETF approval rise, XRP’s chances of reaching new record highs by year-end are becoming increasingly likely.