The Profound Impact of Bitcoin Halving: From History to Future Trends

What Is Bitcoin Halving?

Bitcoin halving occurs when the block reward miners receive is reduced by half every time 210,000 blocks are mined. Originally programmed into the protocol by Satoshi Nakamoto, this mechanism is designed to control the rate of Bitcoin’s supply growth, ultimately capping the total at 21 million coins. The most recent halving took place in April 2024, reducing the reward from 6.25 BTC to 3.125 BTC. The next halving is projected for around 2028.

Impact of Halving on Supply and Price

The halving event reduces the number of new BTC entering the market, significantly lowering the incoming supply. If demand holds steady or rises, the resulting supply shock typically supports higher prices in the short term. Meanwhile, miners face greater cost pressures after the halving. If price increases don’t offset these costs, less efficient operations may be forced out, further tightening market liquidity.

Historical Price Action After Halvings

Following each previous halving, Bitcoin has typically entered a “rally—correction—acceleration” price cycle. After the 2012, 2016, and 2020 halvings, BTC reached new all-time highs within one to two years of each event. Analysts expect BTC to reach the $120,000–$150,000 range by the end of 2025 if historical patterns persist, and possibly challenge $200,000 should supportive macro trends continue.

Latest News: Trump Media Makes Bold Move

In July 2025, Trump Media & Technology Group announced a $2 billion Bitcoin purchase—an investment that underscores major institutions’ long-term confidence in Bitcoin and could reshape traditional cycle expectations. The interplay of current political and policy trends injects further uncertainty into the post-halving outlook.

Current Price and Market Sentiment

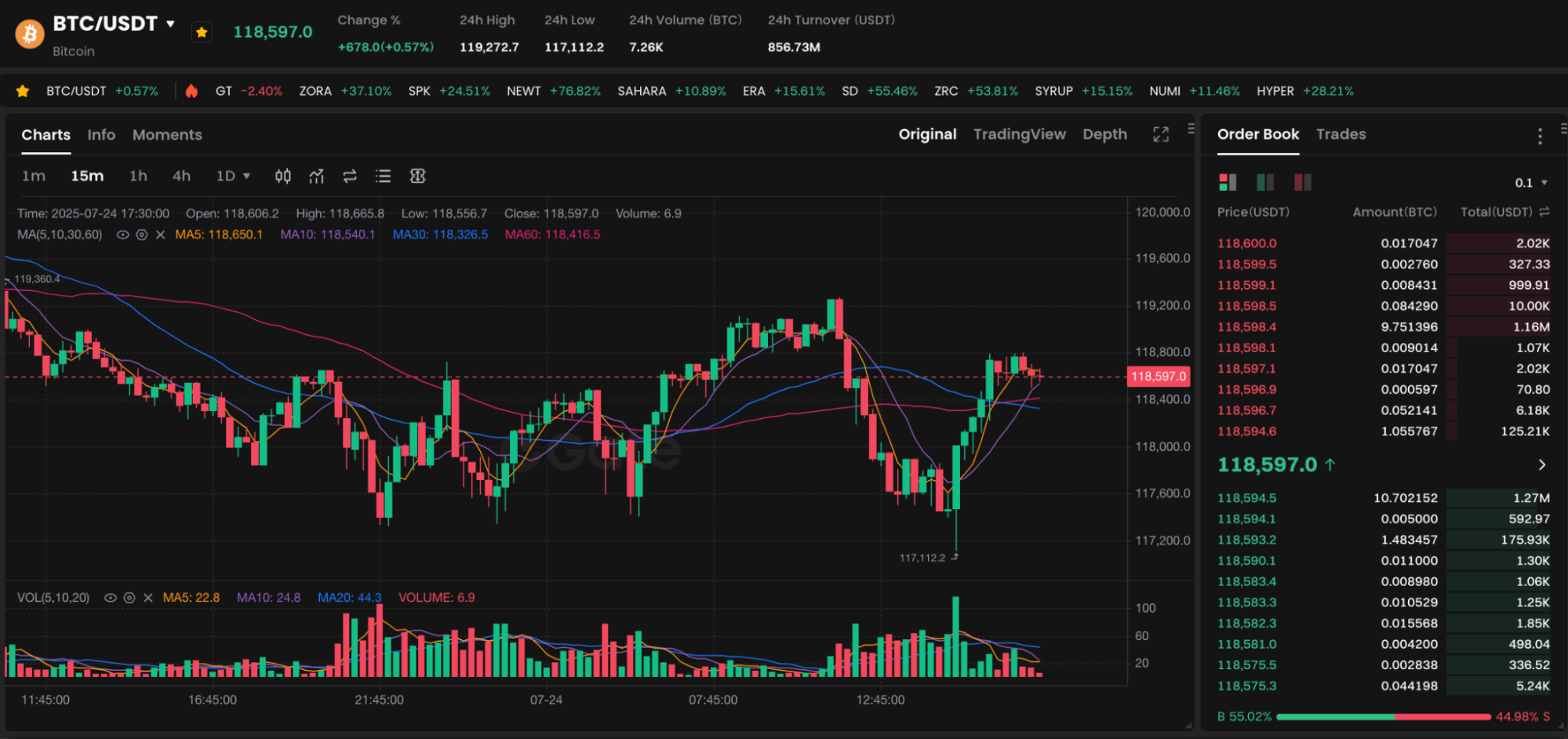

Chart: https://www.gate.com/trade/BTC_USDT

At the time of publication, BTC is trading at $118,725, with an intraday range of $117,428–$119,210. The market remains in a short-term consolidation phase. Institutional buyers are active, while retail sentiment is cautious. Technical analysis and on-chain metrics both indicate that there is still upside potential.

How Investors Can Seize Opportunities

- Use dollar-cost averaging and laddered entries to manage volatility and smooth out entry prices.

- Track on-chain indicators: watch for changes in hash rate, wallet distribution, and exchange balances as key signals.

- Monitor macro policy shifts: ETF approvals and regulatory changes can directly influence capital inflows.

- Set stop-losses and take profits: Avoid all-in bets at market peaks, and secure profits.