Stablecoins Enter the "Interest-Bearing Era": A Panoramic Interpretation of Yield-Bearing Stablecoins

Have you noticed some platforms recently advertising annualized yields of 12% on USDC savings?

This isn’t just hype. In the past, stablecoin holders were essentially “zero-interest savers.” While users earned nothing, issuers invested the idle capital in safe assets like U.S. Treasuries and commercial paper, earning substantial profits. This has long been the playbook for stablecoins such as USDT/Tether and USDC/Circle.

Now, the returns that issuers previously retained are being redistributed. In addition to the interest rate competition among USDC providers, an increasing number of next-generation yield-bearing stablecoin projects are breaking down these “yield barriers,” enabling token holders to directly earn interest from the underlying assets. This shift not only transforms the value logic of stablecoins but could also drive the next wave of growth for RWA and Web3 innovation.

I. What Are Yield-Bearing Stablecoins?

Yield-bearing stablecoins are designed so that their underlying assets generate returns, and these returns—typically sourced from U.S. Treasuries, RWAs, or on-chain yields—are distributed directly to holders. This model stands in clear contrast to traditional stablecoins like USDT or USDC, where all interest income accrues to the issuer and holders receive only the benefit of a dollar peg, with no yield.

With yield-bearing stablecoins, simply holding the token serves as a passive investment. In essence, these products redistribute the interest income from Treasuries that issuers like Tether/USDT previously kept entirely for themselves. Here’s a straightforward example:

When Tether issues USDT, crypto users deposit U.S. dollars in exchange for USDT—so an issuance of $10 billion in USDT means users have deposited $10 billion with Tether, receiving the equivalent amount of USDT.

After collecting $10 billion, Tether pays users no interest. It receives real U.S. dollar funds from crypto users at zero cost. By investing those funds in U.S. Treasuries, Tether earns risk-free interest income.

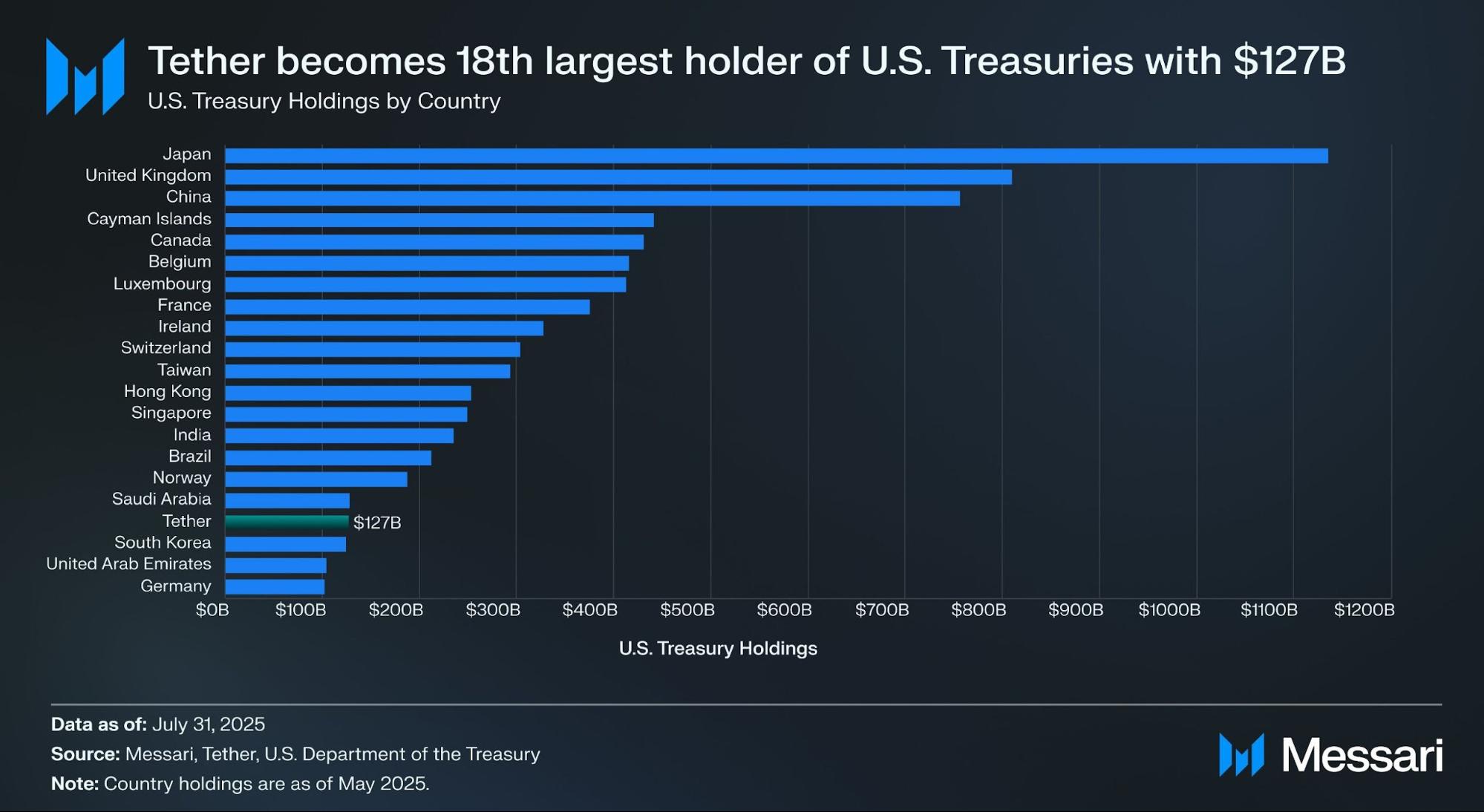

Source: Messari

According to Tether’s Q2 attestation report, it directly holds over $157 billion in U.S. government securities (including $105.5 billion direct and $21.3 billion indirect holdings), making it one of the largest holders of U.S. Treasuries globally. Messari’s data shows that as of July 31, 2025, Tether surpassed South Korea to become the world’s 18th-largest Treasury holder.

Even at a 4% yield on Treasuries, Tether earns about $6 billion in annual interest income (roughly $700 million per quarter). Its Q2 operational profit of $4.9 billion is further testament to the profitability of this business model.

imToken, recognizing that stablecoins are no longer a single-narrative tool and that usage varies by user and need, has divided stablecoins into several distinct subcategories for further exploration (see: Stablecoin Worldview: How to Build a User-Centric Stablecoin Classification Framework?).

Under imToken’s classification, yield-bearing stablecoins form a special subcategory that offers holders recurring returns. These can be divided into two main types:

- Native yield-bearing stablecoins: Simply hold these tokens to automatically earn interest, much like a savings account. The token itself is an interest-bearing asset, e.g., USDe or USDS.

- Stablecoins with official yield mechanisms: These don’t generate interest automatically, but the issuer or protocol provides an official yield channel. Users may need to take further steps—such as depositing into a savings protocol (like DAI’s DSR), staking, or swapping for a yield-bearing receipt token—before earning interest, as seen with DAI and similar tokens.

If 2020-2024 was the “expansion era” for stablecoins, then 2025 is the start of the “dividend era.” With a balance of compliance, yield, and liquidity, yield-bearing stablecoins could become the next trillion-dollar segment within the stablecoin sector.

Source: imToken Web (web.token.im) – Yield-Bearing Stablecoins

II. Leading Yield-Bearing Stablecoin Projects

In practical terms, most yield-bearing stablecoins are closely tied to the tokenization of U.S. Treasuries—on-chain tokens held by users are backed by Treasuries held by custodians. This arrangement preserves the low-risk, interest-bearing nature of Treasuries while providing the high liquidity of crypto assets and enabling DeFi integrations like leverage and lending products.

Alongside established protocols such as MakerDAO and Frax Finance, rapidly growing new entrants like Ethena (USDe) and Ondo Finance are creating a diverse market—from pure protocol models to hybrid CeDeFi approaches.

Ethena’s USDe

The current yield-bearing stablecoin boom has propelled Ethena’s USDe to the spotlight. Recently, its circulating supply exceeded $10 billion for the first time.

As of this writing, Ethena Labs’ website lists USDe’s annualized yield at 9.31%, with prior rates sometimes above 30%. Key yield sources include:

- ETH LSD (liquid staking derivative) staking income

- Funding rate income from delta-neutral positions in perpetual futures

The staking yield is relatively steady at around 4%, while income from delta-neutral positions is market-driven. Thus, USDe’s annualized yield fluctuates based on market-wide funding rates and sentiment.

Source: Ethena

Ondo Finance USDY

Ondo Finance, a key player in the RWA sector, specializes in bringing traditional fixed-income products to on-chain markets.

Its USD Yield (USDY) product is a tokenized note collateralized by short-term U.S. Treasuries and demand deposits. As a bearer instrument, holders do not need to undergo identity verification to own and earn yield from it.

USDY offers on-chain investors exposure similar to Treasuries, with the added composability of tokenization. It can be integrated with DeFi lending, staking, and other modules to amplify returns—making USDY a prominent example of an on-chain equivalent of a money market fund.

PayPal’s PYUSD

Launched in 2023, PayPal’s PYUSD was initially a compliant, payment-focused stablecoin, issued by Paxos and backed 1:1 by dollar deposits and short-term Treasuries.

By 2025, PayPal began testing a yield-sharing mechanism for PYUSD—especially through partnerships with certain custodian banks and Treasury investment accounts—distributing a portion of underlying interest (from Treasuries and cash equivalents) to token holders. This innovation aims to combine payment utility with yield generation.

MakerDAO’s EDSR/USDS

MakerDAO remains a dominant force among decentralized stablecoins. Its USDS (an evolution of the DAI Savings Rate, or DSR) allows users to deposit tokens into the protocol and automatically earn Treasury-linked interest, with no extra steps required.

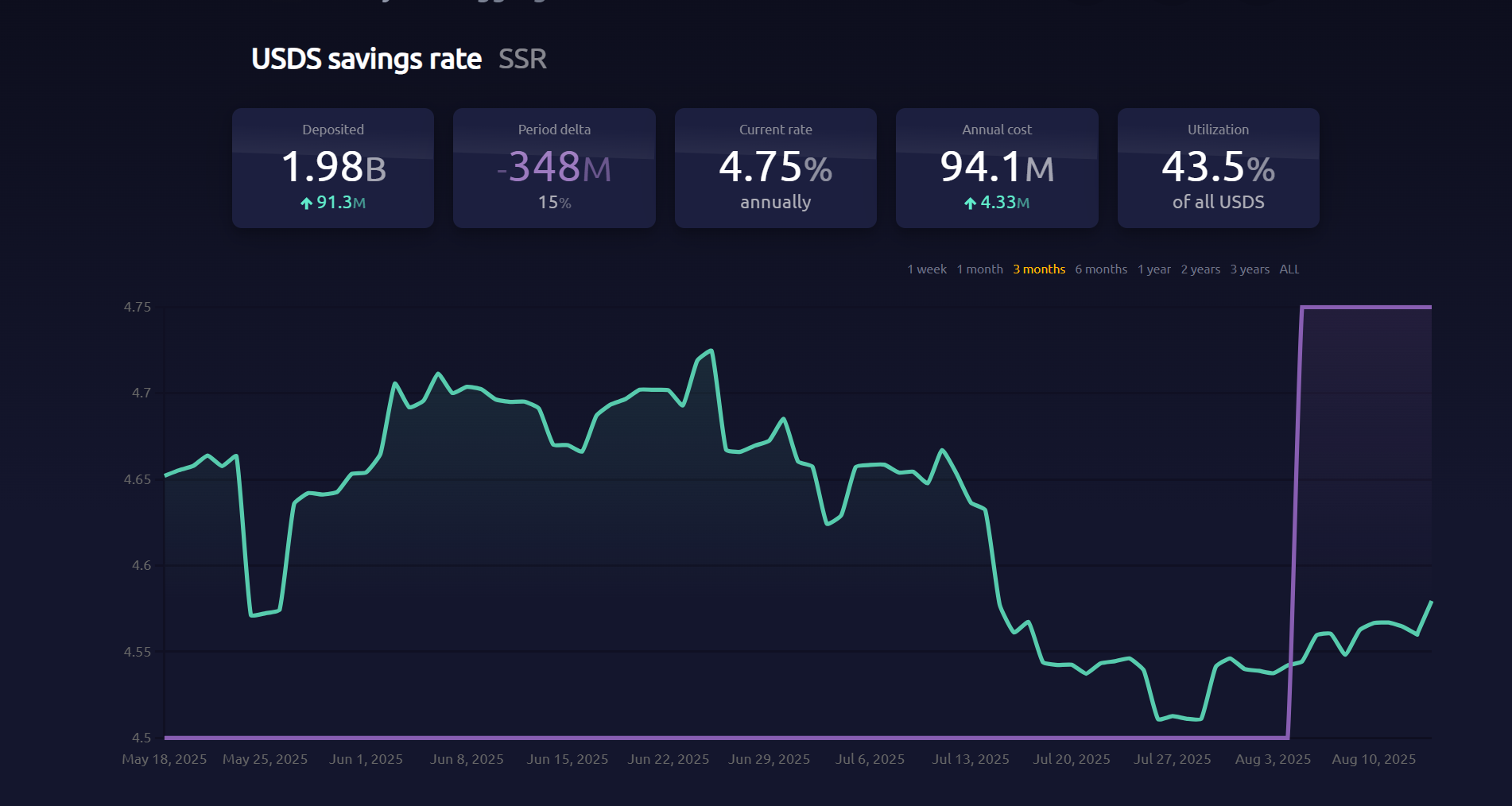

The current DSR is 4.75%, with nearly 2 billion tokens deposited. MakerDAO’s rebranding from DSR to USDS demonstrates its repositioning—from a DeFi-native stablecoin platform to a broader RWA-based yield distribution platform.

Source: makerburn

Frax Finance’s sFRAX

Frax Finance has sought alignment with the Federal Reserve, even applying for a Fed master account. Its sFRAX vault leverages Treasury yields, partnering with Lead Bank in Kansas City to purchase Treasuries via brokerage accounts and track Fed rates for yield optimization.

As of this writing, sFRAX’s total staked tokens exceed 60 million, with a current annualized yield around 4.8%.

Source: Frax Finance

Not all yield-bearing stablecoins have proven sustainable. For example, the USDM project has announced its liquidation: minting has been permanently disabled, and only limited-time redemptions remain available.

Overall, most yield-bearing stablecoins are backed by short-term Treasuries and repurchase agreements, offering market yields in the 4%-5% range, consistent with current Treasury rates. As more CeFi firms, regulated custodians, and DeFi protocols enter the field, these assets are likely to claim a larger share of the stablecoin market.

III. How Should We View Yield Enhancements in Stablecoins?

As discussed, the ability of yield-bearing stablecoins to offer sustainable yields fundamentally depends on prudent management of underlying assets. Most yields come from ultra-low-risk, stable-return assets like U.S. Treasuries and other RWAs.

From a risk perspective, holding Treasuries is nearly as safe as holding U.S. dollars, but with Treasuries you gain an annual yield of 4% or more. During periods of elevated yields, these protocols invest in Treasuries, deduct operating costs, and distribute part of the interest to token holders. This creates a closed loop between Treasury interest income and stablecoin adoption.

Simply holding the stablecoin serves as proof of ownership, entitling the user to the underlying Treasury yield. With mid- and short-term U.S. Treasury yields at or above 4%, most stablecoins backed by Treasuries offer rates in the 4%-5% range.

This “hold-to-earn” model is highly attractive: retail users can put idle funds to work. DeFi protocols get high-quality collateral for lending, leveraged, and perpetual products. Institutions can deploy capital on-chain in compliant, transparent structures, lowering both operational and compliance costs.

Yield-bearing stablecoins are poised to become one of the most accessible and scalable RWA applications. The crypto market is witnessing rapid growth in RWA-based fixed-income products and stablecoins backed by Treasuries. From on-chain native protocols and payment giants to Wall Street-backed newcomers, the new competition landscape is already taking shape.

Regardless of future Treasury yields, this yield-bearing stablecoin boom—driven by the high-yield cycle—has shifted the stablecoin value narrative from “dollar peg” to “dividend.”

In retrospect, this turning point may prove to be not just a milestone for the stablecoin story, but also a landmark moment in the convergence of crypto and traditional finance.

Disclaimer:

- This article is reprinted from [TechFlow], and copyright belongs to the original author [imToken]. If you have concerns about this reprint, please contact the Gate Learn team. We will address your request promptly and according to our policies.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article were translated by the Gate Learn team. Do not reproduce, distribute, or plagiarize these translations unless Gate is properly cited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

What Is USDT0