NFT is experiencing a renaissance, but is Solana's co-founder pouring cold water on it?

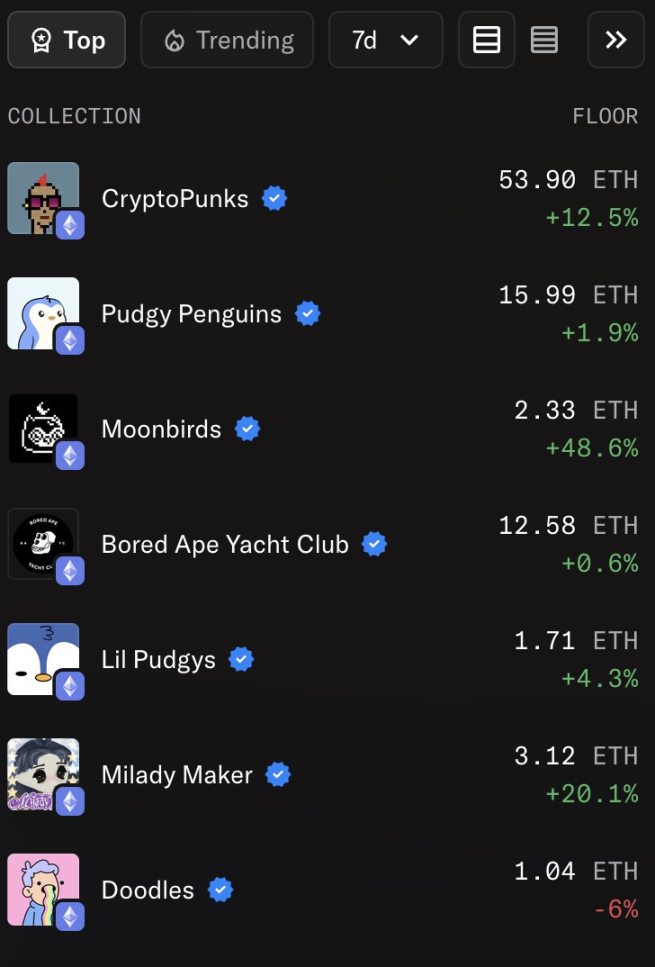

NFTs appear to be tracking ETH’s path back to $4,000, as leading blue-chip NFT collections are finally emerging from an 18-month prolonged market downturn and showing renewed vitality.

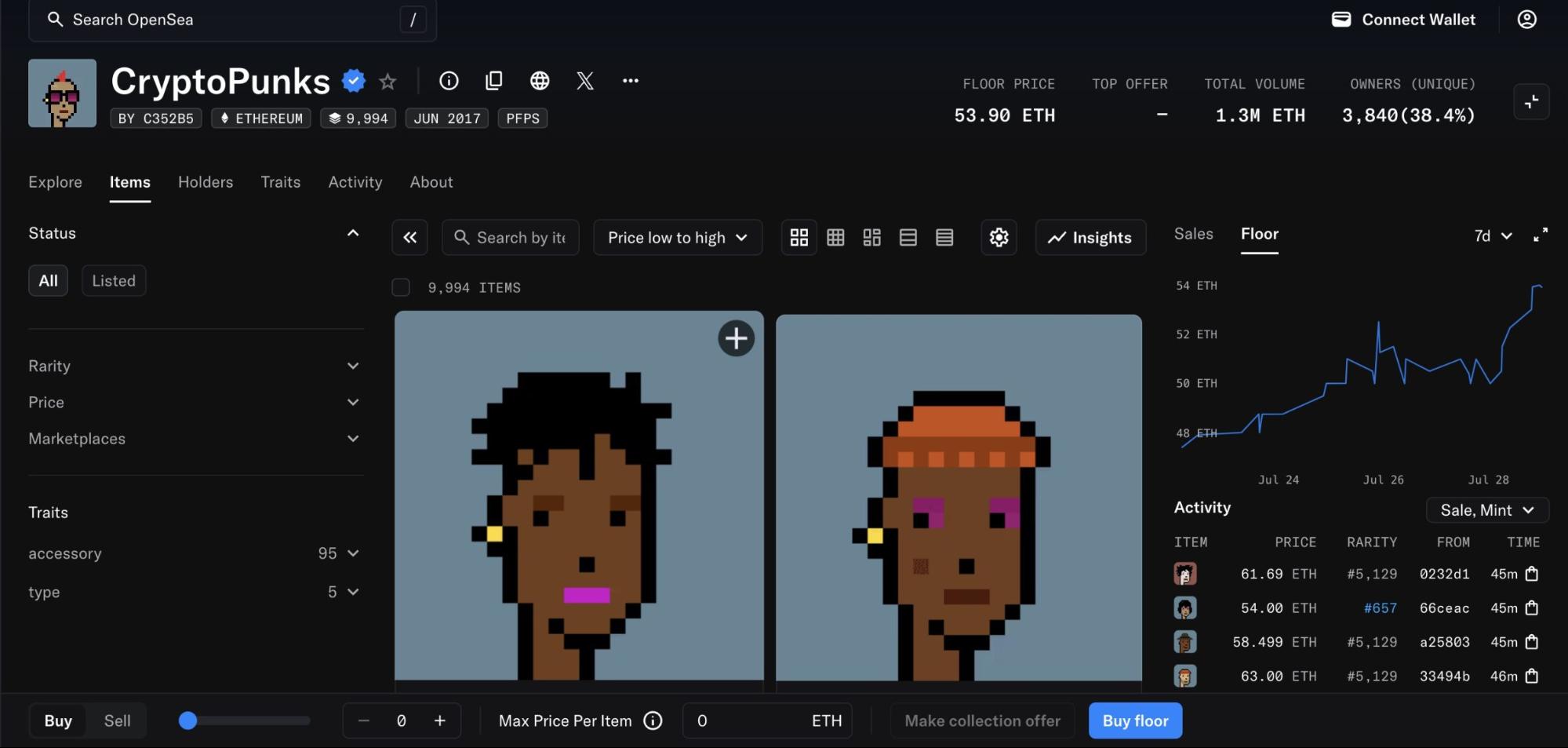

Last week, the CryptoPunks NFT collection registered over $24.6 million in trading volume, hitting its highest level since March 2024 and increased by 416% week-over-week.

On July 24, GameSquare—a Nasdaq-listed company—announced that its board had approved a strategic acquisition of CryptoPunk #5577 from DeFi protocol Compound’s founder and Superstate CEO, Robert Leshner. According to the deal, GameSquare issued $5.15 million in preferred stock to Robert Leshner, convertible at $1.50 per share into about 3.4 million shares of GameSquare’s common stock.

This transaction fueled a trading frenzy for CryptoPunks NFTs, sending both the floor price and average sale price sharply higher. Now that public companies are becoming major holders, NFTs seem poised for a corporate-driven “rescue.”

Arthur Hayes had previously observed that as ETH rallies, DeFi and NFTs tend to follow suit—and even predicted that this cycle, holding ETH might underperform owning CryptoPunks.

Other ETH blue-chip NFTs have also gained in tandem over the past week. Moonbirds’ floor price broke above 2 ETH, up nearly 50%, while Milady Maker cleared 3 ETH with gains exceeding 20%.

Market participants are just beginning to drive the NFT rally. Last Sunday, Anatoly Yakovenko (Solana co-founder) and Jesse Pollak (Base founder) clashed on Twitter over whether creator tokens on Zora are comparable to anonymous meme coins on Pump.fun.

Jesse Pollak argued that creator tokens on Zora—and their underlying content and creators—hold unique value, and it’s a logical fallacy to equate them with Pump.fun meme tokens. Anatoly Yakovenko countered that such tokens mainly spread virally, with buyers simply hoping to flip them for a quick profit. Pollak fired back that tokens are powerful technology for enabling creator value to flow—and skeptics are free to believe “content has no value.”

Yakovenko stated directly during the debate: “Memecoins and NFTs are digital junk with no intrinsic value.” He compared these digital assets to the loot box mechanisms found in free-to-play video games.

Though Solana has benefited enormously from memecoin-driven activity from 2024 through Q1 2025, Toly himself has repeatedly—and publicly—said that memecoins lack intrinsic value.

Ironically, Toly has fully taken on the role of a “memecoin promoter,” gaining notoriety in the community for energetically hyping Solana-based memes. By the late stages of the Solana meme boom, his credibility as a trusted promoter had evaporated.

Two years prior: from the launch of Silly Dragon in December 2023 through Lunar New Year 2024, Silly Dragon exploded as Solana’s leading viral meme. The meme’s origin was simple—Toly liked the dragon mascot and even appeared at events dressed as the character.

When Silly Dragon launched, Toly followed the account when it had just 1,454 followers, which triggered a tenfold increase within just one to two hours.

As the Silly Dragon community kept growing, Toly doubled down—moving from subtle dragon emoji tweets to directly retweeting memes from related projects.

Looking back at how Solana rose from obscurity to the third-largest public blockchain by market cap, its early success was built on ultra-low transaction costs that made it the top pick for new NFT and protocol launches. NFTs and memes—hallmarks of crypto-native communities—helped Solana forge one of the strongest communities in the entire crypto space. Toly’s attempts to distance himself from NFTs and memes, or morally judge speculative assets from a lofty perch, left the community with a sense of discontent toward his actions.

Disclaimer:

- This article is republished from [Foresight News] with the copyright belonging to the original author [Bright, Foresight News]. For concerns regarding this republishing, please contact the Gate Learn Team; the team will promptly address your request in accordance with our procedures.

- Disclaimer: The opinions and views expressed are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn Team. Unless specifically credited to Gate, copying, distributing, or plagiarizing any translated article is prohibited.

Share