Hotcoin Research | Unveiling Altcoin Season Rotation Patterns, Current Phase, and Trend Forecast

I. Introduction

With Bitcoin recently breaking above $120,000 and setting a new high, the crypto market is heating up as we approach a brewing "altcoin season." Altcoin season describes a period in which non-Bitcoin crypto assets (altcoins) collectively outperform Bitcoin—prices soar, and investor sentiment becomes euphoric. Notably, this bull market cycle differs from previous ones. Global macro interest rates remain high, crypto regulation is easing, institutional funds are steadily flowing in through ETFs, corporations are increasingly adopting crypto treasury strategies, and meme coins are rampant. These factors give this altcoin market cycle distinctive new features.

This article reviews the patterns and characteristics of sector rotation during past bull market altcoin seasons, while analyzing how the 2025 altcoin season differs from earlier ones based on today's macro environment and capital flows. We break down the stages and rotation rhythm in altcoins, assess the market's current status, spotlight sectors and assets worth watching, and provide retail investors with strategy tips to stay rational, capitalize on opportunities, and manage risk during the hype.

II. Historical Recap: Altcoin Seasons and Sector Rotations in Bull Markets

The concept of "altcoin season" entered the mainstream around 2017. In the early years, Bitcoin dominated crypto, while other "altcoins" were comparatively tiny. But after Bitcoin rallied past $3,000 and then $10,000 in 2017, money started spilling from Bitcoin into Ethereum and a surge of ICO tokens, sparking the first true altcoin mania. The period from Q4 2017 to early 2018 is often cited as the first textbook “altcoin season,” when nearly any token could deliver massive returns. Noteworthy phenomena from that time include:

- Capital rotation: After a strong Bitcoin rally, BTC typically stalls, and savvy investors take profits, looking for higher-risk, higher-return trades. Funds rotate first to ETH, then to major public chains, then to large-cap altcoins, and finally even the smallest caps and meme tokens. In this process, Bitcoin's market dominance drops sharply—from around 80% in February 2017 to below 32% by January 2018. This rapid decline in BTC dominance is a key signal for the start of altcoin season.

- Performance: Altcoins as a whole far outpaced Bitcoin. During the 2017 ICO boom, BTC climbed from under $1,000 to nearly $20,000 (a 20x gain). In the same period, Ethereum exploded from about $10 to $1,400 (more than 100x), and tokens like XRP saw even more astonishing returns. CoinMarketCap data shows that in the 2021 altcoin season, many top altcoins surged severalfold or even tenfold in just 90 days. Over 75% of the top 50 altcoins outperformed Bitcoin—classic altcoin season behavior. For example, between February and May 2021, large-cap altcoins averaged +174% gains, while Bitcoin moved just +2%.

- Sentiment and trading frenzy: FOMO swept the market—virtually any new token was in demand. Social media buzzed with “Token XX just doubled. Did I buy too late?” Telegram and Discord were filled with “got rich” screenshots, and retail newbies poured in. Influencer trade calls were everywhere, exchanges rushed to list new tokens, and instant 2x pops at launch became the norm. Sentiment stayed at “extreme greed,” and each wave of speculation got more intense than the last.

- Sector rotation: Although it looked like everything was rising, a closer look revealed clear sector rotation. In 2017, the initial hot theme was ICOs (Ethereum and the ERC20 boom), then platform/public chain tokens (EOS, NEO) took the lead, with privacy coins (Monero, Dash) also seeing their moments. By 2021, rotation became even more marked: the DeFi boom in summer 2020 set off the altcoin rally, followed by the Layer1 chain wars (BSC, Solana), the NFT wave in early 2021, then meme coins (DOGE, SHIB, etc., with Elon Musk’s backing), then the metaverse/GameFi boom toward year-end. Each sector had a turn leading, then cooled as attention shifted again. Altcoin seasons typically lasted several months.

Although altcoin season can bring enormous wealth, it’s also often a sign that the bull cycle is nearing its end. History shows that when altcoins surge across the board and the whole market focuses on “10x small tokens,” new capital often dries up. The market becomes exuberant but fragile. When momentum stalls, bubbles burst fast: After the January 2018 peak, the altcoin market cap halved within weeks, leaving many investors trapped at the top. The May 2021 crash reinforced how risk spikes after such frenzies. Altcoin seasons appear in every cycle, but always entail huge volatility and risk. Investors must seize opportunity but also stay alert for turning points.

III. The Macro Backdrop for 2025 Altcoin Season: Capital Flows and Key Differences

By July 2025, the altcoin market is broadly rallying—CryptoBubbles shows major altcoins up 20% to 200% for the month, a “sea of green,” which signals that money is rotating out of Bitcoin into the wider crypto market.

Source: https://cryptobubbles.net/

This cycle, both the overall environment and altcoin action have evolved. After Bitcoin’s fourth halving (April 2024), the market started rallying as expected. But the macro backdrop is very different: major central banks have not shifted fully to dovish policy after the 2022–2023 tightening—liquidity is not as abundant. Thus, today's bull run is more about capital rotation and future expectations than excess liquidity. We see several new patterns in capital flows:

- Stablecoins as main inflow vehicle: Previously, altcoin season often meant Bitcoin mooning, holders’ net worth jumping, and profits rolling into altcoins. This time, capital is not mainly coming to altcoins from BTC sell-offs, but entering directly via stablecoins. Both retail and institutions now prefer to buy altcoins using fiat-converted stablecoins. This shows stablecoin infrastructure is mature, and signals that much of the new money is bypassing BTC entirely. Bitcoin is no longer the only on-ramp—stablecoins have become the “reservoir” for fresh capital.

Institutional money and the ETF effect: This time, traditional institutions are participating at a new level. With spot Bitcoin and Ethereum ETFs approved in early 2025, institutional money is flowing in—mainly diverted from stocks and gold, with a focus on BTC and other majors, not riskier small-cap coins. We now see a split: institutional flows (ETFs) keep BTC rallying and even draw attention away from altcoins. This is the opposite of previous bull runs, where BTC led and pulled ETH/altcoins up together. Now, institutional flows make BTC more independent as the capital magnet.

Meme mania dividing speculation: While institutions focus on BTC, in the wild world of retail speculation, a new trend has emerged: tiny-cap meme coins on-chain are absorbing massive speculative capital. Fast-mint platforms like Pump.fun create endless new meme coin opportunities. These coins often lack any real fundamentals, but early buyers can get wildly rich, fueling a stampede of copycats. This has siphoned much of the speculative flow that used to go to major altcoin projects into meme tokens instead. Early adopters sometimes see multiples within days, but latecomers are often left as liquidity collapses and prices crash 70–90%. This kind of severe “capital cannibalization” among altcoins is a new phenomenon, fragmenting the retail frenzy and further diluting inflows to mainstream alts.

- Narrative booms and political drivers: Macro and political developments now directly influence crypto—a new feature for altcoin season. U.S. President Trump’s pro-crypto stance, the Trump Group’s entry into crypto (launching World Liberty Financial and $WLFI token, and advocating Bitcoin as a strategic national reserve) have created explosive “political narrative” trades, pushing MAGA, TRUMP, and related coins higher. Looser regulatory and rate policy in the U.S. is also fueling imagination. Political momentum has elevated crypto to a strategic level—something unseen in previous cycles. At the same time, “AI narrative,” “Web3 social,” and other tech trends are constantly generating new hypes, leading to a highly fragmented hot sector landscape.

Take all this together, and it’s clear the 2025 altcoin season is fundamentally different: money is rotating rapidly across sectors instead of lifting all ships at once, with narrative-driven booms and busts happening in each area. From AI agents and SocialFi to Politifi, SciFi, Ethereum restaking, DePIN, and RWA, each mini-sector has its flash-in-the-pan surge. The old pattern of “everything rises together” is fading—altcoin season is now more a sequence of narrative-powered rotations than a universal rally.

IV. Altcoin Rotation Phases & Rhythm: Which Stage Are We In?

While the style of this altcoin season has evolved, the phased pattern of capital rotation persists. Historically and in the current cycle, the altcoin season typically plays out in four stages, proceeding from “big” to “small”:

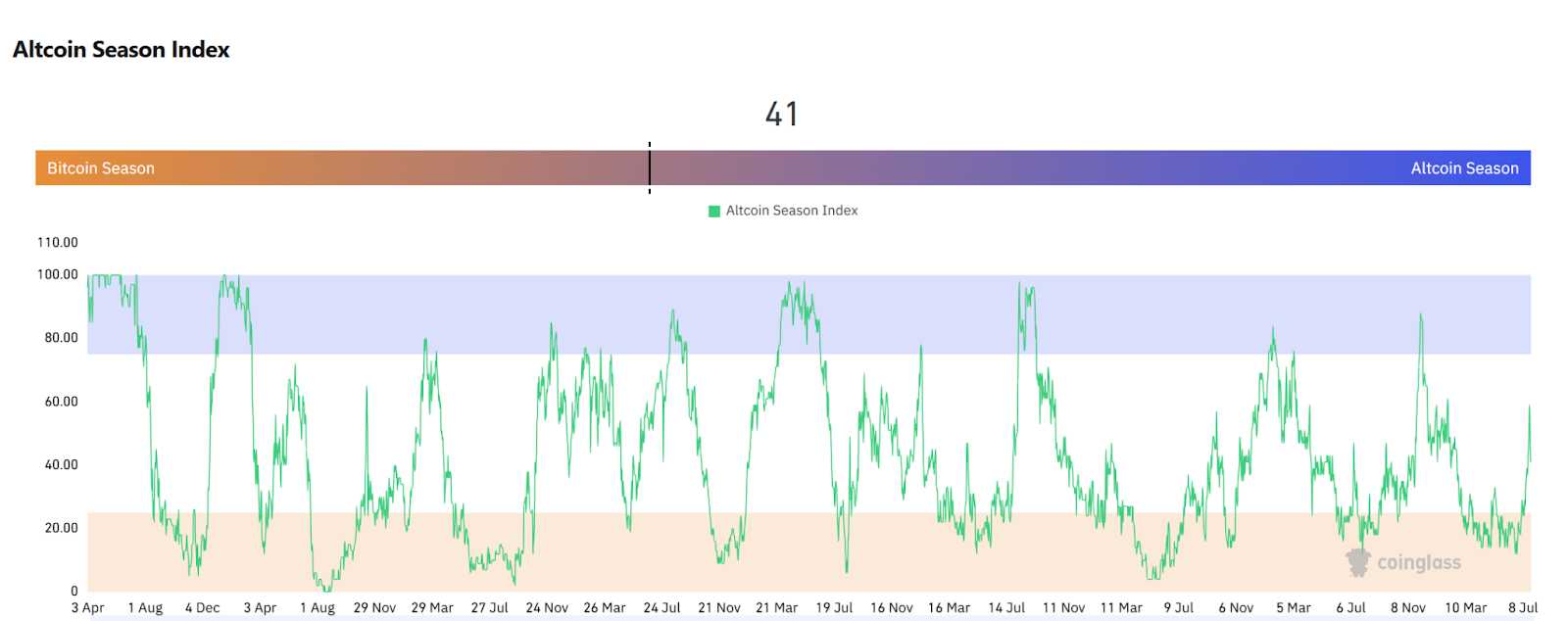

Stage 1 – Bitcoin Leads (Altcoin Season Index: 0–25):

At this stage, the market is driven by BTC, with capital flooding in, boosting its price and market share. The altcoin season index is low (0–25), meaning BTC dominates and altcoins may rise but underperform BTC. This is common early in bull cycles or during recovery. In early 2025, BTC led the rally, with dominance hitting multi-year highs above 65%. Investors’ mindset: “Hold BTC as the core.”Stage 2 – Ethereum & Large Caps Begin to Move (Altcoin Season Index: 25–50):

When BTC’s rally stalls, “capital overflow” takes effect. Smart money takes profits from BTC and rotates into ETH and other large caps. ETH/BTC rises and there’s talk of “Ethereum flipping Bitcoin.” Activity on Ethereum dApps boosts its profile. In late stage 2, money flows into other top 20–30 coins (BNB, SOL, ADA, etc.) for catch-up rallies. Currently, market signs show we’re at the back end of this stage (Altcoin Season Index near 50): ETH is outperforming BTC and funds are rotating more broadly.Stage 3 – Large-Cap Altcoins Outperform (Altcoin Season Index: 50–75):

Once ETH has run higher and risk appetite increases, capital expands into other large caps. The top altcoins (L1s, platforms, etc.) tend to rally together, with strong and sustained gains. Sentiment is upbeat, but not extreme. The altcoin season index sits in the 50–75 range, meaning most major altcoins now beat BTC. At this point, savvy investors may start taking partial profits on big runners.Stage 4 – Small Cap & Mania Peak (Altcoin Season Index: 75+):

This is the climax and endgame. Nearly every token, regardless of fundamentals, soars in a broad, irrational spike. The altcoin season index is very high (75–100), meaning almost all altcoins are trouncing BTC. Typical tells include: memes like DOGE mooning; media headlines talk of “frenzy” and “banquets”; BTC’s dominance breaks below 50% or even 45%. But this stage is also the riskiest and most frothy. If the index goes beyond 75 and keeps climbing, investors should be ready to de-risk fast.

Source: https://www.coinglass.com/pro/i/alt-coin-season

As of July 2025, the data show that altcoin season is underway but not yet at peak mania. Specifically, Bitcoin surged in the first half of the year and kept dominance above 60%—Stage 1 is finished. ETH is now consistently outperforming BTC—that’s classic Stage 2. Large caps like SOL and ADA are beginning to show strong rallies, suggesting we’re moving into Stage 3. The full-on small-cap mania of Stage 4 has not arrived: the Altcoin Season Index sits between 40–50 (not extreme); BTC’s dominance has only fallen a few points from the highs and the “cliff” drop hasn’t happened yet. Meme coin activity is rising, but true mania isn’t here. We’re likely in late Stage 2 or the start of Stage 3—large caps are leading, and momentum is beginning to spill into mid/small caps.

V. Sectors & Tokens to Watch Right Now

While this round of altcoin season features rapid sector rotation and less “all boats rise” behavior, there are still major opportunities. Picking the right sectors and quality coins is still the path to outperformance. In this fragmented, hype-driven environment, investors must recognize what’s truly capital- and fundamentals-driven, versus what’s mere speculative noise. Here’s a sector-by-sector breakdown, referencing research and market trends:

- RWA (Real World Asset): The RWA sector has dominated this cycle. RWA protocol tokens have averaged 15x or greater gains, far outpacing other sectors. The sector thrives by meeting institutional needs—putting real-world assets (bonds, bills, real estate) on-chain bridges traditional finance and crypto. Focus on major, battle-tested projects (like ONDO, SKY), which have more institutional adoption and robust risk management.

- AI: The AI narrative is sizzling in Web3. AI and blockchain combine in several ways: blockchains can verify AI data sources and model training; token economics can incentivize AI compute or data sharing; and on-chain “AI Agents” can autonomously execute tasks. The “AI Agent” boom earlier this year exemplifies this. Watch out: many AI projects lack real business models and are driven by hype, but tech-strong or big-partner projects still deserve attention. Highlights include Bittensor (TAO), which is building a decentralized machine learning network; and the July 2024 merger of Fetch.ai, Ocean Protocol, and SingularityNET into the Artificial Superintelligence Alliance (ASI), with AGIX and OCEAN merging into FET, which later converts into ASI. Virtuals Protocol (VIRTUAL) is breaking new ground by combining blockchain with AI for advanced deployment, monetization, and agent interaction.

- DePIN: DePIN (Decentralized Physical Infrastructure Network) refers to using crypto incentives to build out real-world infrastructure. Helium rewards IoT hotspot deployment; Pollen Mobile builds decentralized wireless; Filecoin powers distributed storage. Research says DePIN will be a major 2024 theme, pushing crypto incentives into the real economy. DePIN projects attract deep-tech capital and can run on independent cycles. Helium boomed in 2021; Filecoin’s decentralized storage is back in focus. With strong fundamentals and undervalued tokens (FIL, HNT), DePIN could re-rate as the market shifts from purely financial hype to real tech. These are for patient, mid- to long-term investors—don’t overexpose, as DePINs entail higher tech and policy risks (wireless spectrum, hardware, etc.).

- Layer2 & Modular Chains: Layer2 tokens (ARB, OP) may ride the surge in on-chain activity as more users migrate in a bull. Robinhood, for example, is launching tokenized stock trading—and a dedicated RWA Layer2—on Arbitrum. Modular blockchain (like Celestia, which separates execution from data layers) is another key tech theme. Once proven, foundational innovations like Celestia’s TIA may catch significant capital flows.

- DeFi 2.0 & Next-Gen Finance: DeFi is quieter this bull than during the 2020 DeFi summer—after a brutal 2022, core DeFi project valuations (Uniswap, Aave, Compound) dropped 70%+. If the market keeps warming and capital returns on-chain, revenue-generating DeFi protocols could see significant re-rating. The Ethereum Shanghai upgrade unlocked new restaking/LSD protocols (EigenLayer, Pendle, etc.). DeFi sector investors should track: protocol revenue and fee growth, TVL trends, governance, and buyback/burn activity.

- Meme coins: Meme coins are always a crypto staple—they mushroom every late bull. BONK, PENGU, USELESS, as well as DOGE, SHIB, PEPE, all have had moments. Meme coin investing is like a social psychology experiment—moves depend on mood and story, not underlying value. This cycle, many on-chain meme coins have pumped and then crashed 70–80%, confirming their “hot potato” nature. If you want exposure, treat it as small-position entertainment with strict risk management—never ALL IN, or you’ll likely be the last one holding the bag.

VI. Retail Investor Playbook: Rational Navigation of Altcoin Season

Altcoin season can be thrilling, but for retail investors, staying cool amid the frenzy and skillfully managing risk is essential for long-term wins. Here’s our tactical guide—focused on risk controls, position sizing, and trading rhythm—to help retail investors thrive amid the altcoin hype.

Risk first, profit second: Once altcoin season begins, remember that opportunity and risk always coexist. History shows the steepest rallies are often followed by the worst drops. Prepare for 30–50% (or bigger) drawdowns at any time. When everyone is hyped about a “10x coin,” odds are you’re near the top. Remind yourself: “The 80/20 rule always applies—only 20% make real gains; 80% become exit liquidity.” Keeping risk top-of-mind keeps you rational in the craze.

Position sizing and diversification: For high-volatility altcoins, managing your position size is critical. Never go all-in on a single name. However promising, black swans happen. The best approach: allocate most funds to stable core assets (BTC, ETH, or top 10 coins) to anchor your portfolio, and only a minority (perhaps 20–30%) to speculative bets. This lets your portfolio withstand broad altcoin corrections. Also, diversify within altcoins and across themes—never bet the farm on a single trend.

Ride the tide, mind the rhythm: Follow the market’s rhythm, don’t fight it. In stages 1–2 (BTC/ETH leaders), stick with the strong and limit rotation—weak coins are laggards for a reason. When stage 3–4 arrives and altcoins rally, roll some BTC profits into strong altcoins, but monitor for sentiment peaks. When tiny tokens are mooning and new retail is flooding in, you may be near the end—de-risk. Use objective cues: the Altcoin Season Index is valuable—when it’s >75 for a while, caution is warranted. Also watch for BTC dominance breaking below critical levels (like 50%) and for telltale “ecstasy” headlines.

Set targets and stops—and follow your plan: Discipline is everything in a fast market. Before buying, define your exit: “Sell part if a token is +50%/+100%; cut if it drops −20%.” Stick to the plan so emotions don’t dictate trades. Small caps need strict stops—when the music stops, drops can be savage. Take profits in stages—locking in gains as you go is more realistic than aiming for the exact top. That way, you pocket wins while giving remaining positions a chance to run.

Stay rational—never be ruled by greed or fear: Altcoin season will challenge your nerves. When your holdings pump daily, it’s easy to overconfidently pile in, or even borrow to go bigger—but that’s high risk. Conversely, after a crash, panic can drive you to sell the bottom. Remind yourself of your discipline. If you can’t stay cool in high volatility, reduce trades, cut size, or even step aside. As the saying goes, “There’s always another opportunity—just make sure you’re still around.” Never go all-in on greed or let panic cloud your judgment.

Conclusion

Altcoin season is both a launchpad for dramatic wealth and a crucible of emotion where greed and fear battle. Past bull markets reveal the cyclical rotation of altcoin themes and countless tales of both triumph and bubbles. Even in 2025’s more fragmented, fast-rotating environment, the driver is the same: human risk appetite and the pursuit of fresh opportunity. For everyday investors, it's vital to balance embracing the upside of altcoin season and respecting market risk. Good fortune comes to the prepared—may you enjoy the ride and walk away with both gains and safety.

About Us

Hotcoin Research is the core research division of the Hotcoin ecosystem, dedicated to providing global crypto asset investors with professional analysis and forward-looking insights. Our three-pronged service model—trend analysis, value discovery, and real-time monitoring—combines deep dives into crypto industry trends, multidimensional evaluation of high-potential projects, and 24/7 market tracking. Through our twice-weekly “Hotcoin Select” strategy livestream and daily “Blockchain Today” news briefings, we offer precise market interpretation and actionable strategies for investors at all levels. Powered by cutting-edge data analytics and industry networks, we help retail investors build their knowledge frameworks and professional institutions capture alpha, seizing the value growth opportunities of the Web3 era.

Risk Disclaimer

The cryptocurrency market is highly volatile and investments carry risk. We strongly advise that investors fully understand these risks and adhere to strict risk management protocols to protect their capital.

Disclaimer:

- This article is republished from [TechFlow]. Copyright belongs to the original author [TechFlow]. If you have concerns regarding this reprint, please contact the Gate Learn team, and we will address your request promptly as per our policy.

- Disclaimer: The opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article have been translated by the Gate Learn team; they may not be copied, distributed, or plagiarized without explicit mention of Gate.

Share

Content