Can Etherex fire the first shot before Linea's coin launch?

As Linea is set to announce its LINEA tokenomics and governance details at the end of this month, its ecosystem DEX, Nile, is also undergoing a significant upgrade.

The Linea mainnet has long lacked a trading layer that could deliver cross-chain liquidity while returning value to the community. The upgraded version of NILE—Etherex—is designed to fill the gaps in Linea’s ecosystem concerning exit mechanisms, efficient liquidity aggregation, and incentive design.

Etherex introduces an innovative x(3,3) model that is more flexible than ve(3,3), eliminating the need for token locking. By leveraging dynamic incentives and exit penalties, Etherex ensures that the protocol’s value is channeled to the most active participants.

This article will break down Etherex’s core mechanisms, tokenomics, and its key innovations.

From Nile to Etherex

Etherex is a decentralized exchange (DEX) developed through the collaboration of Linea, ConsenSys, and NILE, officially launching on July 29, 2025. Partners include Astera, Foxy, eFrogs, MYX, MetaMask, Alchemix, Frax, Zerolend, and Turtle.

According to the Etherex team, as far back as 2014—and before the Ethereum mainnet went live—Ethereum founders like Vitalik Buterin and Joseph Lubin envisioned a truly decentralized, trustless, secure exchange, empowering users to trade freely on-chain without reliance on centralized entities. EtherEX emerged from that vision. Although it wasn’t realized at the time, today’s Etherex pays tribute to this early ambition and takes it further. Etherex is not simply a rebranded DEX; it’s the “ultimate realization” of the original 2014 EtherEX concept.

Practically, Etherex is Nile’s upgraded version on Linea. As Linea’s native liquidity hub, Etherex fulfills three main roles: allocating targeted incentives, providing liquidity support for the LINEA token, and steering the issuance of valuable new tokens to liquidity pools that benefit the ecosystem.

What Is Etherex?

Etherex’s core innovation lies in its x(3,3) model—an advanced evolution of the traditional metaDEX model that solves previous incentive alignment challenges.

Traditional metaDEXs demonstrated that large-scale adoption and sustainable yields are possible, but depended on forced token locking—requiring users to lock up tokens for years just to participate. This led to a participation model driven more by obligation than by actual value.

The x(3,3) model rewrites this logic: instead of requiring mandatory locking, it uses organic incentives so users stay by choice. The system rewards those who actively participate, concentrating value in the hands of the highest contributors. Users can join without locking tokens, and the design of the exit mechanism naturally filters for participants who truly believe in the protocol’s value, forming a self-selecting, highly active community.

How Does Etherex Work?

As outlined above, Etherex replaces forced participation with voluntary retention and contribution. Its main objective is to provide Linea with native deep liquidity, optimized incentives, and a seamless user experience.

How Does the Three-Token System Align Incentives?

Before diving into Etherex’s mechanics, it’s crucial to understand its three-token system.

Etherex adopts an innovative three-token framework designed for precise incentive alignment while retaining flexibility. Although not all details have been disclosed, the core mechanism is as follows:

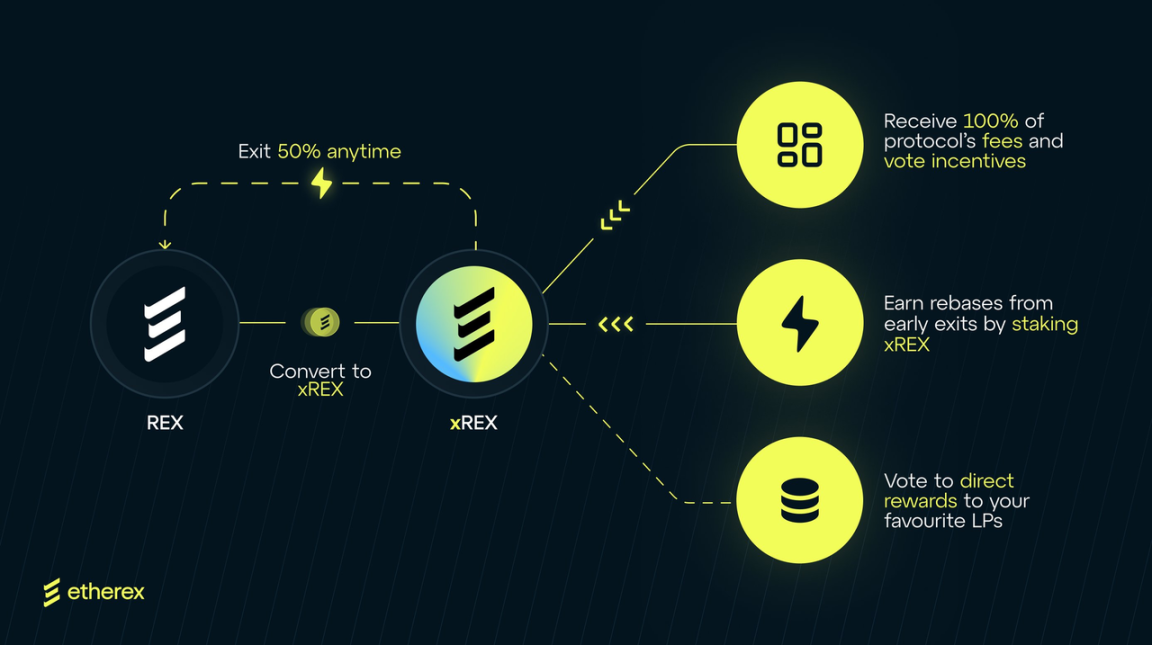

- xREX: The governance token. Active xREX stakers hold voting rights to decide emission allocations to liquidity pools. They also receive 100% of trading fees, Exit Rebase rewards, and additional protocol incentives.

- REX33: The liquid-staked version of xREX, with auto-voting and auto-compounding, addressing governance token liquidity issues. Initially, REX33 and xREX have a 1:1 ratio, but as fees, voting incentives, and rebase rewards accumulate, this ratio increasingly favors REX33. Etherex uses an arbitrage mechanism to ensure REX33 maintains at least the redemption value of xREX, offering low-friction participation.

- REX: The protocol’s base token, distributed via emissions to liquidity pools to incentivize liquidity providers. Emission amounts are determined by xREX holder governance votes, ensuring resources flow to the most valuable pools.

How Etherex Operates

1. Positive Exit Mechanism Loop

Users can leave xREX by: (1) Direct redemption (Exit Rebase), incurring a 50% penalty—penalized tokens are distributed to existing xREX holders; or (2) trading REX33 (the liquid-staked xREX) on the open market. This approach addresses dilution and rewards long-term participation, creating a “survival of the fittest” ecosystem.

2. Weekly Epochs: Every Thursday at 08:00, xREX holders vote to decide which liquidity pools will receive REX emissions for the coming week. Voting weight depends on xREX holdings and participation, and pools with higher votes receive more emissions.

3. Adaptive Fees and Revenue Distribution

Etherex automatically adjusts trading fees (0.05%-5%) based on market volatility and trading activity, and allocates 100% of protocol fees to xREX holders. Higher trading volume attracts more votes and releases more tokens, boosting liquidity and creating a flywheel effect for growth in volume and fees.

4. Concentrated Liquidity (CL) Optimization

- LPs can set custom price ranges for their liquidity, maximizing capital efficiency.

- Competitive farming rewards LPs for optimizing liquidity range, improving trade quality.

5. MEV Protection and Value Recapture

Etherex integrates an MEV capture module (such as REX33 AMO) to distribute arbitrage profits to voters.

Etherex Tokenomics

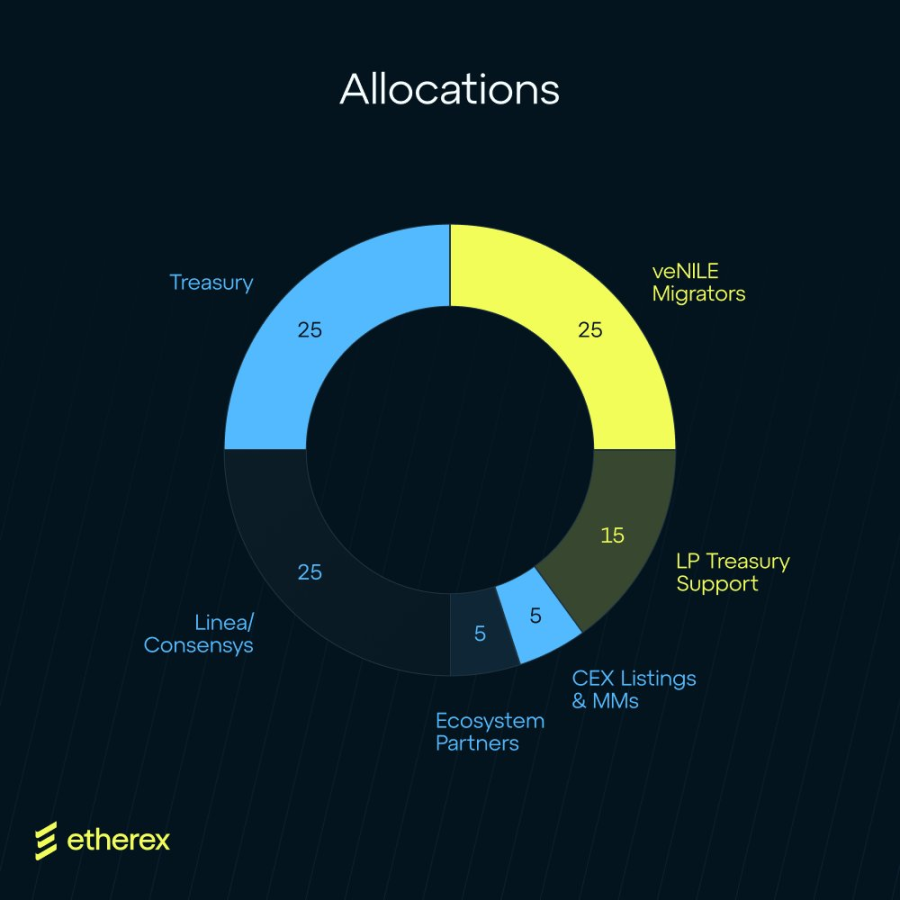

Etherex will launch its REX token on August 6. The initial total supply is 350 million tokens, with a maximum cap of 1 billion. Distribution is as follows:

- 25% to Linea/Consensys (80% xREX, 20% REX. Existing veNILE holders can migrate to xREX at 1:1, provided they have at least 100 veNILE and a maximum lock period of 4 years. Snapshot at 11:59 on July 26, Beijing time [UTC+8]).

- 25% to veNILE migrators (100% xREX).

- 25% to the protocol treasury.

- 15% to the LP treasury.

- 5% to centralized exchanges and market makers.

- 5% to ecosystem partners.

Apart from allocations for the LP treasury and CEX/market makers (which are REX), most distributions are in xREX.

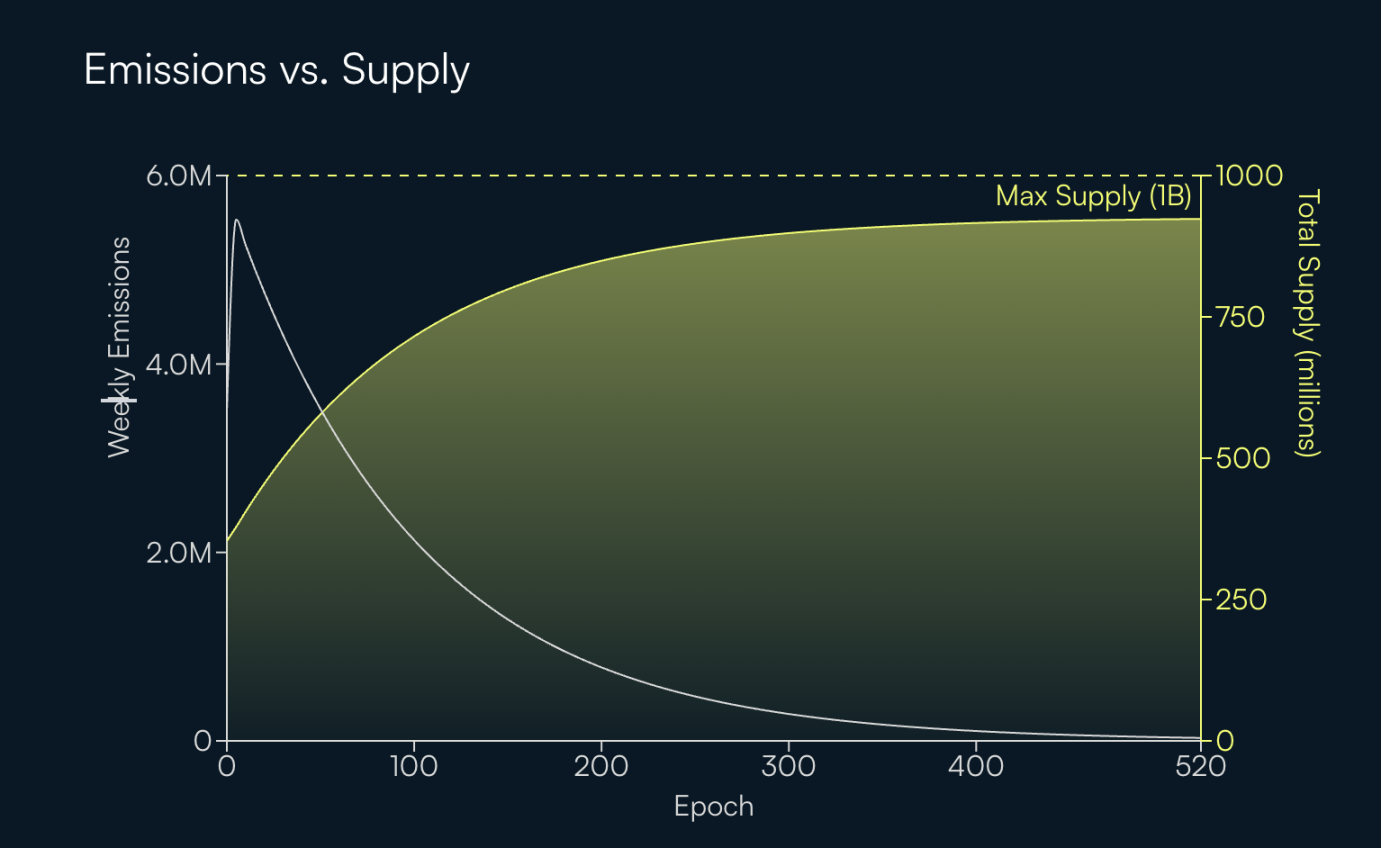

As noted earlier, xREX holders vote to determine which pools will receive REX emissions for the following week. The chart below shows Etherex’s weekly emissions (white curve) and the projected total supply over the first 500 epochs (about 10 years, yellow curve). During epoch 0, 3.5 million tokens are released. From epochs 1 to 4, emissions rise by 20% in the first epoch and 10% in subsequent epochs. After epoch 5, emissions decrease by 1% per epoch.

Why Is Etherex a Critical Building Block for the Linea Ecosystem?

Etherex brings several key values to the Linea ecosystem:

First, the x(3,3) model fundamentally addresses liquidity incentive misalignments—shifting from forced participation to value-driven engagement, letting liquidity naturally pool in the most efficient segments, and protecting long-term contributor rewards via the Exit Rebase mechanism.

Second, Etherex’s tight integration with MetaMask and its no-locking requirement significantly lower barriers for users and liquidity providers, expanding the ecosystem’s user base.

In addition, as Linea’s native liquidity hub, Etherex fosters alignment with the Ethereum ecosystem—its incentive design supports both the short-term growth of Linea and Ethereum’s long-term goal of becoming a vital economic infrastructure.

Notably, the Ethereum treasury company SharpLink currently holds over 360,000 ETH, and Ethereum co-founder and ConsenSys CEO Joseph Lubin serves as chairman of SharpLink Gaming. The community speculates that SharpLink may allocate a portion of its ETH holdings to Etherex.

Whether Etherex, with its novel x(3,3) model, coordinated tokenomics, and seamless user experience, will become the growth engine for the Linea ecosystem remains to be seen.

Disclaimer:

- This article is republished from [Foresight News], with all rights reserved by the original author [KarenZ, Foresight News]. For any concerns regarding republication, please contact the Gate Learn Team, who will promptly address them in accordance with applicable procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Other language versions of this article are translated by the Gate Learn Team. Reproduction, distribution, or plagiarism of these translations is prohibited unless Gate is explicitly cited as the source.