a16z's prediction: Vibe coding will be a winner-takes-all proposition? Wrong. Vertical specialization is the future.

Have you noticed that AI application generation platforms are moving in a direction that’s completely different from what most people anticipated? Many expected a bloody, zero-sum competition—a price war leaving only one dominant player. Yet the reality has been unexpected: instead of a fight to the death, these platforms are each carving out distinct, differentiated positions and thriving together across specialized market segments. This reminds me of how the large language model market unfolded: equally surprising and deeply instructive.

Just yesterday, a16z partners Justine Moore and Anish Acharya co-published an analysis titled “Batteries Included, Opinions Required: The Specialization of App Gen Platforms”—their observations on the AI app generation platform market resonated strongly with me. They noted that these platforms are undergoing differentiation similar to what we’ve seen with foundational models, evolving from direct competition to focused specialization. This prompted me to reconsider the rules governing the entire AI tool ecosystem and reflect more deeply on the myth of the “one-size-fits-all platform.” I’ve long believed that “no universal code platform can rule them all.” Today, with so many people building with AI, their use cases are remarkably diverse: prototyping, personal websites, game development, mobile apps, SaaS platforms, internal tools, and more. How could a single product possibly excel across all these domains?

My view is that the market will inevitably trend toward segmentation. A consumer-oriented app for beautiful landing pages will never be the same as an enterprise-grade internal tool builder. The first needs Spotify integration and can go viral on TikTok; the second needs SOC 2 compliance and is sold top-down to CTOs. The market is large enough to support several multi-billion-dollar companies. The winning strategy is to become the unequivocal leader in a specific use case—focusing on the features, integrations, and go-to-market strategies required to own that segment.

PS: I recently launched a vertical, specialized Vibe coding startup, and we’ve just quickly closed a round of pre-seed financing. If you’re a VC partner interested in this space—or have research and thoughts to share—I’d love to connect on WeChat (MohopeX). We’re also recruiting for our founding team; see the end of this piece to apply if you’re interested.

Foundational Model Lessons: From Substitutes to Complements

Looking back at the foundational model market in 2022, nearly everyone made two flawed assumptions. First, people believed these models were largely interchangeable, like swapping out cloud storage providers. If you’d chosen one, why bother with another? Second, since they were seen as substitutes, competition would drive prices to rock bottom, and the only way to win would be to charge the lowest rates.

But reality played out entirely differently. What we saw was an explosion of growth in all directions. Claude doubled down on code and creative writing. Gemini carved out a unique spot in multimodal capabilities, offering high performance at a low price. Mistral focused on privacy and local deployment. ChatGPT staked its claim as the go-to “hub” for anyone seeking the broadest, most useful general-purpose assistant. The market never consolidated into a monopoly; instead, it continued expanding: more models, more diversity, more innovation. Prices didn’t fall—they rose. Grok Heavy, with its outstanding AI coding features and viral text-to-image models, now charges $300 a month—an unheard-of price point for consumer software just a few years ago.

We’ve seen this in other fields, too. Back in 2022, people said image generation would be a zero-sum game—“one model to rule them all.” But now you have Midjourney, Ideogram, Krea AI, BFL, and many others, all successful, all coexisting, each specializing in different visual styles or workflows. These models aren’t “better” or “worse”—they express their own artistic vision and feature sets, serving a range of creative tastes and demands.

Look closer and you’ll see these models aren’t really competitors—they’re complementary. This is the opposite of a downward price spiral. It’s a positive-sum game: using one tool increases your likelihood of paying for another. My personal experience illustrates this. I use Claude to quickly generate code; Gemini for multimodal analysis; and ChatGPT when I need help with creative writing. Each tool has its sweet spot. They’re not fighting for my attention—they’re fulfilling different needs at different times.

Specialization Has Begun Among AI App Generation Platforms

I see the same phenomenon emerging in AI app generation platforms. These tools help users build full applications using AI. It’s tempting to focus on surface drama—whether it’s Lovable versus Replit versus Bolt and so on. But in reality, this isn’t a winner-takes-all fight. The market is huge and still growing, with plenty of room for multiple breakout companies to thrive in their niches.

As Justine points out, the market is already segmenting, with each platform excelling uniquely in a particular area:

- Prototyping platforms: Tools for quickly testing ideas. These need to shine in aesthetics, prompt compliance, and fine-grained visual controls, while providing rapid, rough implementation of business logic.

- Personal software platforms: Tools for building apps customized to your own workflows. These may cater to the least technical users, requiring an out-of-the-box experience and comprehensive, easy-to-edit template libraries.

- Production app platforms: Tools ready for team or public deployment, with essential built-in features like authentication, database, model hosting, payments, and seamless one-click scaling.

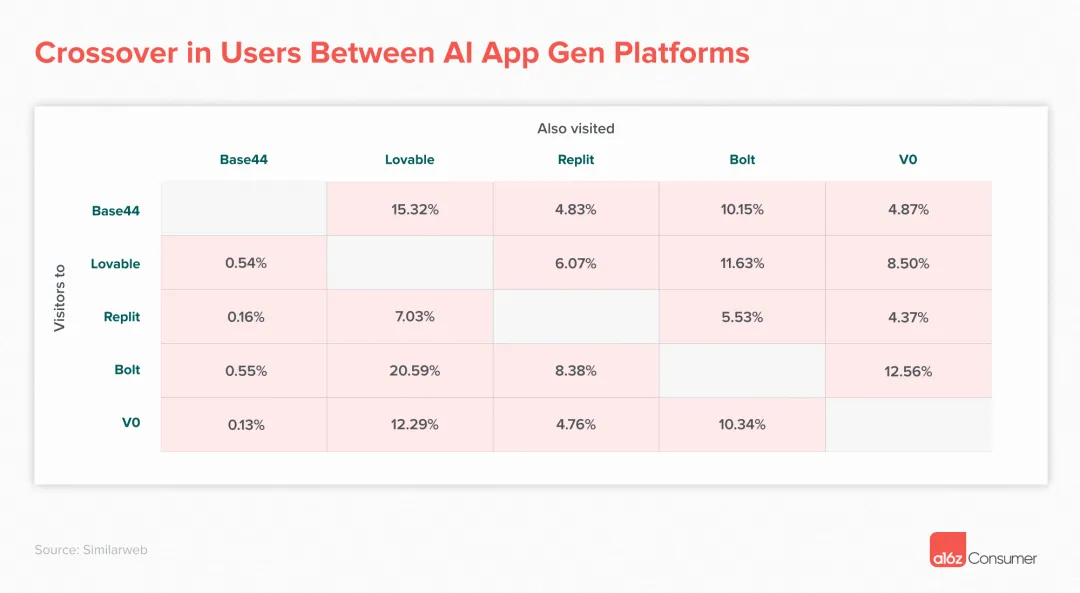

Each category likely contains platforms for every user tier, from general consumers to semi-technical product managers to core developers. In short, every app type will have a tailored solution. Data from Similarweb shows that, though early, this segmentation is emerging in core platform cross-browsing patterns—covering names like Lovable, Bolt, Replit, Figma Make, v0, and Base44.

The data shows two user archetypes. The first is single-platform loyalists: over the past three months, 82% of Replit users and 74% of Lovable users in this group visited only Replit or Lovable. These users may see app generation platforms as functionally similar for now, but choose a primary one, perhaps due to marketing, UX, or a function they value. Anecdotally, Lovable is mostly for aesthetic web apps and prototyping; Replit is preferred for back-end heavy, complex apps.

The second group is multi-platform superusers. For example, nearly 21% of Bolt users also checked out Lovable in three months, and 15% of Base44 users did the same. I suspect these are highly engaged users leveraging multiple platforms in complementary ways. This matches my own use of design tools: I might use one for rapid prototyping, another for precise design tweaks, and a third for collaborating with devs. Each tool has its unique strengths—I choose based on the task at hand.

Specialization Is Inevitable

I am increasingly convinced that, in tools helping users build scalable applications, specialization and constraints win out over generality. Excelling at a class of application is far better than being mediocre at everything. A platform that’s best for SAP-integrated internal tools is unlikely to also produce the world’s most accurate flight simulator app.

Let’s break down this specialization trend. Different applications place vastly different demands on their platforms:

Data/service wrapper apps aggregate, enrich, or present large existing data or third-party services (think LexisNexis or Ancestry). Infrastructure must support large-scale data manipulation—the core challenge is data processing and integration complexity, not UI polish.

Utility tools are simple, single-purpose apps for highly specific needs—PDF converters, password managers, backup utilities. Most horizontal platforms already handle these fairly well. Simplicity is key, but reliability and performance remain critical.

Content platforms (e.g., Twitch, YouTube) are built for discovery, streaming, and reading, requiring specialized backend to handle massive content distribution—real-time stream processing and personalized recommendation algorithms are the main technical hurdles.

Commerce hubs are transaction platforms focused on logistics, trust, reviews, and price discovery—they must integrate payments, refunds, discounts, and more. Compliance, security, and financial integrations are central challenges.

Productivity tools enable users and organizations to get work done, collaborate, and streamline workflows, often demanding deep integration with other software. Understanding company workflows and existing ecosystems is vital.

Social or messaging apps foster communication and sharing, forming networks and communities. Infrastructure must scale real-time, handle social graphs and audit content in real time.

The point is that every vertical has its own tech stack, integration needs, and UX considerations. A platform specializing in e-commerce apps will optimize for payments, inventory, and order management. A dashboard generator will invest heavily in visualization, real-time data, and query optimization. Specialization is about distinct product philosophy and technical architecture, not just features.

The Deeper Logic Behind Market Segmentation

At a fundamental level, this segmentation reflects the complexity of building software itself. We often treat software engineering as a unified discipline, but in truth, each application type faces unique constraints: mobile apps pose challenges of touch, battery, and offline support; web apps face browser compatibility, SEO, and responsive design; internal enterprise tools demand security, compliance, and integration.

As AI automates app development, these differences only grow in importance. An AI system great at generating stylish landing pages will be optimized around visuals, conversion, and marketing data. An AI tuned for enterprise internal tools will focus on security, integration, permissions, and auditability.

I’ve seen teams attempt a “universal” AI app generation platform for all users and use cases. But this ignores a central reality: conflicting optimization targets. If you pursue both aesthetics and enterprise compliance, you end up compromising both. Specialized platforms can avoid these trade-offs and deliver best-in-class experiences for a specific segment.

This mirrors the history of traditional development tools: all-in-one “super IDEs” gave way to specialized tools for web, mobile, or data science. Each offers an unbeatable experience in its field—far superior to generalist tools.

The same split is likely in AI app generation: platforms specifically for e-commerce (with Shopify integration and payment/operations features), for data dashboards (with data connectivity and visualization), for mobile (with iOS/Android patterns, push, and app store optimization).

User Behavior as a Leading Indicator

The user behavior data cited by Justine is especially revealing. “Superusers” bouncing between platforms validate my thesis: each platform fits distinct use cases. One dev may use Lovable for rapid prototyping, Replit for back-end heavy apps, and other platforms for specific integrations.

This pattern resembles the modern dev toolchain: no one expects a single tool to do everything. We use Figma for design, VS Code for coding, GitHub for version control, Vercel for deployment, Stripe for payments—each best-in-class in its lane, the combination is more powerful than any hypothetical “do-everything tool.”

AI application generation will likely follow this path: users will choose the best platform for each need rather than settle for a mediocre generalist. This freedom boosts value across the ecosystem, since every platform can specialize and excel.

One fascinating trend: users are now less sensitive to switching costs. Traditionally, steep learning curves led devs to stick with the familiar. But with AI, natural language interfaces drastically lower onboarding barriers, encouraging users to find the optimal tool for every task. This further accelerates specialization.

Rethinking Business Models

This specialization will upend business models for AI app generators. Traditional SaaS bets on scale and network effects, aiming to capture and lock in the widest user base. In a specialized world, depth matters more than breadth.

A platform focused on e-commerce apps can integrate deeply with Shopify, WooCommerce, BigCommerce and more, delivering an experience unmatched by generalists. Its customer count may be lower, but each client is far more valuable and loyal. These specialized players can even pioneer vertical pricing models, such as revenue sharing on transactions rather than pure subscriptions.

Likewise, a platform specializing in enterprise internal tools can integrate tightly with existing IT infrastructure, offering SSO, data sync, compliance, and audit. Selling directly to large customers through enterprise sales, they don’t depend on self-serve models.

I believe this business model diversity will create a healthier, more balanced competitive landscape. Each platform serves its user base without trying to be everything for everyone, which reduces head-to-head battles and helps each player build true moats in their segment.

From an investment perspective, different platforms will appeal to different investors. Consumer app generators will attract those seeking viral growth; enterprise platforms will draw investors looking for stable cash flow and long-term customer relationships. This diversity will bring more funding and attention to the entire sector.

Differentiation in the Tech Stack

At the technical level, I’ve found each app genre demands a distinct technology stack, further validating the case for specialization. A real-time app platform (chat, collaboration, etc.) must optimize for WebSockets, messaging queues, and state sync. A data-heavy platform must invest in query optimization, caching, and visualization.

Another intriguing trend: platforms are now diverging in their AI model choices and optimizations. UI-driven generators leverage image models and design datasets; logic-driven generators focus on code models and architecture datasets. Targeted optimization gives each platform a pronounced edge in its field.

More importantly, every app type has a different standard for quality. Consumer apps prioritize UI appeal and smooth UX—even messy code may be allowed. Enterprises care more about maintainable, secure, extensible code—even if the interface is basic. These differences require tailored optimization and quality control for each platform.

I also note differences in deployment and operations. Platforms for personal projects may offer simple one-click static hosting. Enterprise-focused offerings need robust CI/CD pipelines, environment management, monitoring, and alerts. These nuances make all the difference to users.

How the Ecosystem Is Evolving

Zooming out, the specialization of AI app generators is a microcosm of broader shifts in software development: from a “tools-centric” world to an “outcomes-centric” one. Users care less about what tools they use, more about what results they achieve. That shift unlocks huge opportunities for vertical and specialized platforms.

I expect to see many more vertical AI app builders emerge: dedicated platforms for game development (with deep engine and design expertise), for education (with LMS integrations, progress tracking, adaptive learning), for healthcare (HIPAA compliance, industry standards), and more.

This verticalization will reshape talent needs as well. Successful platforms will need hybrid talent—people who deeply understand both AI and their industry. For example, a finance app generator will require staff truly versed in compliance, risk, and trading systems. This shift reinforces the moat for specialist platforms.

Cooperation is becoming more common than competition. A front-end-focused platform might partner with a back-end one to offer users a seamless end-to-end solution. This collaborative ecosystem lets every player focus on what they do best.

Ultimately, this specialization will drive the entire AI app development sector to new heights. As every niche matures and is served by tailored solutions, the industry will advance and users will benefit. It’s a win for everyone—platforms can build defensible businesses, users get precisely what they need, and the whole ecosystem becomes richer and more diverse.

My Outlook and Predictions

Drawing on these observations, I foresee the AI app generation market splitting into several major categories over the next three to five years: consumer rapid prototyping platforms, template platforms for small businesses, custom internal tool platforms for large enterprises, and a range of vertical, industry-specific platforms.

Each segment is likely to end up with two to three dominant players, winning by going deep and building a robust ecosystem. These platforms won’t try to displace one another; instead, they’ll double down within their own field and deliver a level of specialized value that’s difficult to match.

I’m especially optimistic about platforms that can build a durable moat within a vertical. Take a restaurant-focused platform that deeply integrates point-of-sale, inventory, scheduling, and financial reporting—these are nearly impossible for a generic platform to replicate. Deep industry expertise and specialized integration are hard to dislodge.

I also expect a fundamental shift in user behavior. As switching costs fall, users will become highly “tool rational,” picking the optimal platform for each use case rather than remaining loyal to a single provider. This will accelerate specialization—being the best in a field is the only way to secure a permanent spot in a user’s toolbox.

Technologically, I expect specialized platforms to further differentiate their AI model training and optimization. The demands of each field will drive the creation of models specifically tuned for code generation, UI design, business logic, and more.

Most importantly, I believe specialization will redefine what “platform success” means. In the past, success meant biggest user numbers or widest reach. Now, it will mean the deepest influence within a field, highest customer value, and greatest expertise. This evolution will bring new business opportunities and make the overall industry stronger and more sustainable.

In sum, the trend toward specialization in AI application generation is not just a technological inevitability—it’s a sign the market is maturing. As user needs diversify and become more sophisticated, the limits of generic solutions become clear. Platforms that deeply understand and serve their target users will gain a lasting edge. This market is big enough to support many successful niche players—what matters is finding your positioning and mastering it.

Conclusion

A stealth AI startup, already backed by leading USD funds at the pre-seed stage, is recruiting founding team members. Job descriptions are below—if interested, scan to apply. For the overseas growth role, there are only two requirements: intelligence and English fluency. I’ll personally teach the rest.

Disclaimer:

- This article is reproduced from [Leo] and remains the copyright of the original author [Deep Thinking Circle]. If you have concerns about this reprint, please contact the Gate Learn Team; we will handle it promptly through the appropriate process.

- Disclaimer: The views and opinions presented in this article are solely those of the author and do not constitute investment advice.

- Other language versions have been translated by the Gate Learn Team. Do not copy, distribute, or plagiarize this translation without explicit mention of Gate.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge