Ethereum (ETH) Price Prediction: Price Trends and Influencing Factors

Analysis of the Core Factors Affecting ETH Price

1. The change in the use of funds by the Ethereum Foundation

Traditionally, the Ethereum Foundation (EF) has been a potential source of selling pressure that the market has focused on, especially when the ETH price approaches the upper range, as its sell-off often triggers a chain reaction in the market. However, the latest actions in May 2025 show signs of transformation.

EF borrowed $2 million worth of GHO stablecoins from the decentralized lending protocol Aave, using wrapped ETH (WETH) as collateral, obtaining funds without selling any ETH. This strategy is seen as EF starting to use DeFi tools for leverage operations, retaining assets while flexibly funding project development, demonstrating a long-term belief in Ethereum itself and innovative financial applications.

Marc Zeller, the founder of the Aave Chan Initiative (ACI), stated that Aave is designed for believers. He emphasized that such operations by the EF belong to a looping strategy, which is the logic of reusing funds from collateralized borrowing and reinvestment, widely used in the DeFi space to amplify profits and liquidity.

(Note: GHO is a decentralized stablecoin issued by Aave)

2. The market’s fear of ETH sell-off has cooled down.

According to on-chain data, EF has sold approximately 130,000 to 160,000 ETH over the past few years, and as of the end of 2024, it holds about 240,000 ETH. With this change in fundraising strategy, the community’s concerns over EF’s continuous selling have begun to diminish. Notably, as early as February this year, EF had deployed 45,000 ETH to major DeFi lending protocols including Aave, Compound, and Spark, with Aave receiving over 30,000 ETH in liquidity. These actions not only stabilize the ecosystem but also indirectly alleviate potential selling pressure in the market.

3. Signals for Institutions and New Capital Entry

In addition to the actions of EF, another driving force behind the rise in ETH prices comes from institutional capital inflows:

- Sharplink Gaming (listed on NASDAQ) announced that it will invest $425 million to establish an ETH fund and explore the integration of blockchain gaming and entertainment applications.

- The ETH spot trading platform has seen inflows for eight consecutive days, reflecting that funds are being repositioned, viewing ETH as the next opportunity window.

These trends indicate that the market no longer views ETH merely as a technical protocol token, but as a core asset of the crypto financial system, and it may even evolve into a sovereign asset of Web3.

ETH Technical Analysis and Forecast Outlook

Short to medium-term trend (1 - 3 months)

- Key support zone: $2,200 ~ $2,400

- Break through the resistance zone: $2,800 ~ $3,000

If the funds and narrative continue, along with a stabilization in Bitcoin’s market, ETH is expected to test the $3,000 round number again, which may trigger more arbitrage and leveraged funds to follow.

Long-term forecast (second half of 2025 to 2026)

As the Layer 2 ecosystem matures and Danksharding and EIP-4844 are implemented, ETH will reach new milestones in scalability and transaction costs, providing a more solid foundation for applications such as DeFi, gaming, AI, and RWA.

- Optimistic forecast range: $4,500 ~ $6,000

- Conservative prediction range: $3,200 ~ $4,000

Risk factors: Uncertainty of US regulation, delays in technological progress, pressure from Layer 2 competition

The DeFi narrative of ETH is rising again.

From the leveraged operations of this EF, it not only breaks the past convention of raising funds by selling coins but also refocuses the market on the integration potential of Ethereum and DeFi protocols. If established protocols like Aave and Compound can meet the demand of institutional users and national-level assets, it will drive the revaluation of ETH.

In addition, the logic of leveraging assets without selling them provides another module for capital management and stable liquidity for the entire market. This change is not just a minor adjustment in EF’s strategy, but a significant transformation in the financial logic of the Ethereum ecosystem towards an asset leverage cycle.

ETH price prediction

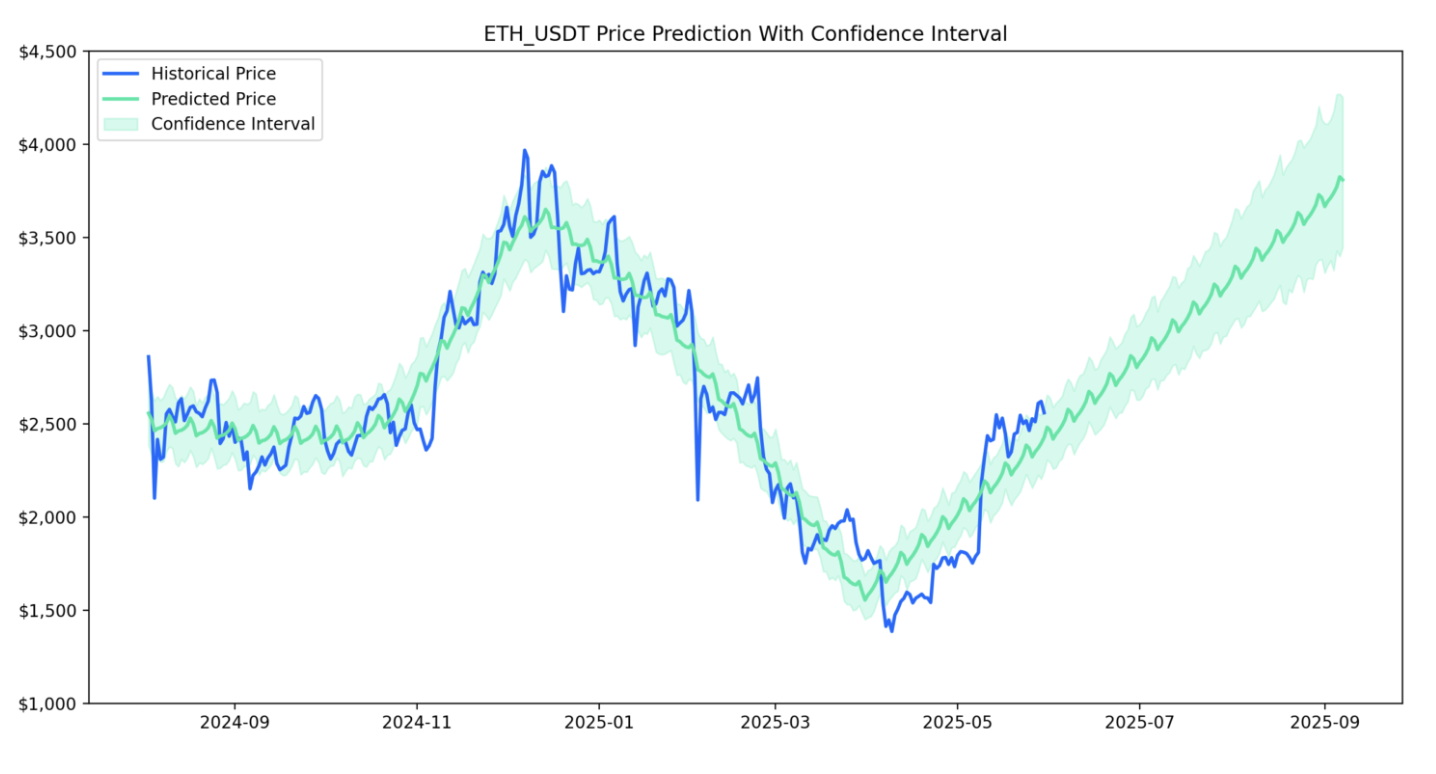

Through AI model data calculations, referencing past ETH prices and related information, predictions for future prices are made solely for data sharing purposes and not as investment advice. Refer to the chart below:

ETH price prediction trend

ETH price prediction and confidence interval

Start trading ETH spot immediately:https://www.gate.com/trade/ETH_USDT

Summary

The price performance of Ethereum is a comprehensive result of market sentiment and capital flow. The behavior of EF abandoning sell-offs and embracing DeFi is not just a simple asset allocation adjustment, but it could be a key step in driving the maturity of the entire Web3 financial model. With the development of Layer 2 and modular blockchains, ETH’s positioning as a trust layer and settlement layer will become more solid. The price may fluctuate in the future, but its irreplaceable narrative is gradually being strengthened.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025