- Topic

12k Popularity

12k Popularity

138k Popularity

915 Popularity

20k Popularity

- Pin

- 🎉 Hey Gate Square friends! Non-stop perks and endless excitement—our hottest posting reward events are ongoing now! The more you post, the more you win. Don’t miss your exclusive goodies! 🚀

🆘 #Gate 2025 Semi-Year Community Gala# | Square Content Creator TOP 10

Only 1 day left! Your favorite creator is one vote away from TOP 10. Interact on Square to earn Votes—boost them and enter the prize draw. Prizes: iPhone 16 Pro Max, Golden Bull sculpture, Futures Vouchers!

Details 👉 https://www.gate.com/activities/community-vote

1️⃣ #Show My Alpha Points# | Share your Alpha points & gains

Post your - 🚀 ETH jumped to $4,600 this morning, up 8.69% in 24h!

Just shy of the $4,891 ATH—think it breaks through?

📍 Follow Gate_Square, vote and drop your reason.

🎁 4 winners split $100 Futures Voucher! - 📢 Exclusive on Gate Square — #PROVE Creative Contest# is Now Live!

CandyDrop × Succinct (PROVE) — Trade to share 200,000 PROVE 👉 https://www.gate.com/announcements/article/46469

Futures Lucky Draw Challenge: Guaranteed 1 PROVE Airdrop per User 👉 https://www.gate.com/announcements/article/46491

🎁 Endless creativity · Rewards keep coming — Post to share 300 PROVE!

📅 Event PeriodAugust 12, 2025, 04:00 – August 17, 2025, 16:00 UTC

📌 How to Participate

1.Publish original content on Gate Square related to PROVE or the above activities (minimum 100 words; any format: analysis, tutorial, creativ - 💙 Gate Square #Gate Blue Challenge# 💙

Show your limitless creativity with Gate Blue!

📅 Event Period

August 11 – 20, 2025

🎯 How to Participate

1. Post your original creation (image / video / hand-drawn art / digital work, etc.) on Gate Square, incorporating Gate’s brand blue or the Gate logo.

2. Include the hashtag #Gate Blue Challenge# in your post title or content.

3. Add a short blessing or message for Gate in your content (e.g., “Wishing Gate Exchange continued success — may the blue shine forever!”).

4. Submissions must be original and comply with community guidelines. Plagiarism or re

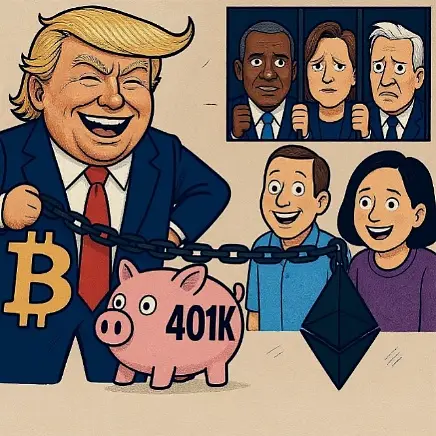

Trillions in pension funds flooding into Crypto Assets? The beginning of a big gamble.

Author: Owen

Recently, U.S. President Trump signed an executive order titled "Democratizing Access to Alternative Assets for 401(k) Investors" at the White House, directing the Treasury Department, Labor Department, and Securities and Exchange Commission (SEC) to initiate rule revisions to include cryptocurrencies, real estate, private equity, and other "Alternative Assets" within the scope of 401(k) pension investments. This news came as a thunderclap, quickly shaking the global financial markets — it not only has the potential to unlock up to $8.7 trillion of retirement fund pools, but is also seen as a crucial step for crypto assets moving from the margins to the mainstream financial system.

Despite the White House claiming that this move aims to "expand ordinary investors' access to diversified assets," a core issue has emerged: does this open a new chapter for wealth appreciation in the retirement future of Americans, or is it a reckless nationwide gamble?

1. 401(k) plan: The cornerstone of the American pension system

To understand the importance of this move, it is essential to clarify the significance of 401(k) within the U.S. retirement security system. The U.S. pension system is composed of three pillars: the first pillar is the government-run mandatory Social Security, which provides basic pensions to retirees on a monthly basis; the second pillar consists of employer-sponsored retirement savings plans, with 401(k) being the most common, where funds are accumulated through employee pre-tax contributions and employer matching contributions, along with limited investment options provided by the employer; the third pillar is Individual Retirement Accounts (IRA), which are voluntarily established by individuals, with a broader range of investment options, and some types of IRAs have long allowed investments in cryptocurrencies.

In the second pillar, the 401(k) is the most representative employer retirement plan, and most employers support employees' participation, accumulating funds through payroll deductions and matching contributions to achieve compound growth. In addition to the 401(k), there are also 403(b) plans for employees of public education institutions and certain non-profit organizations. As of the first quarter of 2025, the market size of the U.S. 401(k) has surpassed $8.7 trillion, serving as a core guarantee for the retirement lives of tens of millions of American families.

The biggest difference between IRA and 401(k) as voluntary savings plans compared to mandatory government social security is the investment autonomy: both types of accounts enjoy tax-deferred or tax-exempt treatment for investment earnings, but IRA has a wider range of investments, allowing direct holding of various assets (including allocations in cryptocurrencies in some types); the investment scope of 401(k) has long been restricted, with most funds directed towards low-risk products packaged by employer-selected asset management institutions (such as mutual funds, bonds, etc.), rather than directly holding spot assets. Trump's reform this time is aimed at lifting the restrictions on 401(k) investments, creating institutional conditions for high-volatility assets like cryptocurrencies to enter mainstream retirement investment portfolios.

2. From strict prohibition to release: The turning point between regulatory concepts and market realities

For a long time, the U.S. 401(k) plan has strictly excluded high-risk assets such as cryptocurrencies, primarily to protect the safety and stability of retirement savings. The high volatility is fundamentally at odds with the goal of steady growth in pensions, and regulators are concerned that ordinary investors lack the capacity to bear risks and make professional judgments. Once the market experiences severe fluctuations, it will directly impact their pension security. At the same time, financial institutions face additional costs and risks in custody, valuation, and compliance, which has also led to a long-term tightening of policies.

The recent executive order signed by the Trump administration to ease restrictions is not a spur-of-the-moment policy decision, but rather the result of multiple overlapping motivations: on one hand, it is a response to the public's demand for high-yield channels in an environment of low interest rates and high inflation, fulfilling the campaign promise of "deregulation"; on the other hand, it is a realization of political capital—the cryptocurrency industry supported the Trump camp during the campaign, and his family also has investments in the crypto space; the deeper background is that the crypto market is no longer a marginal experiment, but is gradually being seen as a mainstream asset, driven by institutional investment, ETF approvals, and the acceleration of global compliance processes.

It is worth noting that this policy is not only aimed at cryptocurrencies but also at a broader category of "Alternative Assets," whose official definition includes private equity, real estate, commodities, and digital currencies, among others. This means that the original intention of the policy is to comprehensively relax investment restrictions to expand the options available to individual investors, catering to society's enthusiasm for chasing high-yield assets.

It can be said that this shift from "prohibition" to "release" reflects both the loosening of American regulatory concepts and the changes in the capital market landscape and the reshaping of the political ecology.

3. Far-reaching impact: A gamble may begin here.

Incorporating cryptocurrencies and other Alternative Assets into the 401(k) investment scope means that the U.S. government is embarking on an unprecedented high-risk experiment in the retirement system. Once pension funds enter the crypto market on a large scale, this will not only significantly enhance market liquidity and price stability but will also create a vested interest between the government and the crypto market: when the retirement savings of millions of Americans are linked to crypto assets, the government will have to consider how to maintain market stability in policy-making. This deep entanglement could greatly accelerate the compliance process for cryptocurrencies, forcing regulatory agencies to establish clearer and more comprehensive regulations, thereby increasing the maturity, transparency, and credibility of the entire market, attracting more mainstream institutions and individual investors to participate.

At the same time, a deeper political consideration is that vested interests may even grant pro-crypto policies continuity across party changes. It elevates the protection of cryptocurrencies from being a personal or partisan action of Trump to a "forced choice" by the government to protect the citizens' assets—any measures that undermine the crypto market could be seen by voters as "messing with the cheese of retirement funds," leading to a political backlash.

(When your pension is on the chain, do they still dare to say "no"?)

However, this gamble is fraught with concerns. The crypto market is known for its extreme price volatility, and its cyclical bull-bear transitions are often accompanied by significant asset shrinkage. More critically, the market still harbors structural issues such as fraud, money laundering, and illegal financing, with some assets lacking transparency and security incidents on trading platforms occurring frequently. If pension funds encounter a severe setback in such an environment, the losses will not only be reflected on the balance sheet but will also trigger a crisis of trust on a societal level—affecting the future security of millions of American families directly, and political pressure will quickly transmit to the White House and Congress. At that time, the government may be forced to intervene fiscally to stabilize the market, resulting in a dual hostage situation between policy and the market.

In other words, this move may either promote the entry of cryptocurrencies into an era of institutionalization and comprehensive regulation, or it may backfire on policymakers when risks spiral out of control, turning this "bold attempt" into a period of reflection and even criticism in history.

4. Another Perspective: The Fiscal Game Behind Tax Deferral

For a long time, the U.S. 401(k) plan has two modes of tax treatment: the traditional model takes "pre-tax contributions, taxed as ordinary income upon withdrawal," while the Roth model is "after-tax contributions, withdrawals are tax-free when qualified"—regardless of the model, both allow for the deferral of tax on investment gains, which is its long-term appeal. Therefore, incorporating cryptocurrency assets into the 401(k) investment scope does not change these fundamental tax rules, but signifies that this highly volatile asset has entered a compliant "shell" of tax deferral or tax exemption for the first time, allowing investors to enjoy the tax advantages of the account while betting on the long-term growth of the cryptocurrency market.

In this framework, the fiscal impact resembles a tax game over time. For investors choosing "traditional accounts," current taxable income decreases, leading to a short-term reduction in government tax revenue. However, during the withdrawal phase in the future, it will be counted as taxable income all at once. This is a typical "fishing with bait" strategy—using today’s concessions in exchange for a larger tax base decades later. If crypto assets succeed in the long term, the returns realized upon retirement could far exceed current levels, resulting in higher tax revenue for the government. Conversely, if the market falters or the policy environment shifts, short-term tax sacrifices may lead to long-term fiscal gaps. This also represents the greatest risk and uncertainty of this move from a fiscal and tax perspective.